Scam Struggle: 1 in 3 Americans Victims of Identity Theft

Regardless of where you live or how old you are, identity theft and fraud are issues that touch the lives of Americans. In today’s digital landscape, where technology offers both advantages and risks, the concern about falling victim to scams and deceptive practices is a shared experience.

As the nation’s largest and most secure 1031 Qualified Intermediary, we surveyed Americans to learn more about their experiences with fraud and identity theft and the steps they are taking to protect themselves. For local data, check our recent report breaking down fraud and identity theft reports by city and state.

Top 5 Most Common Scams Targeting Americans

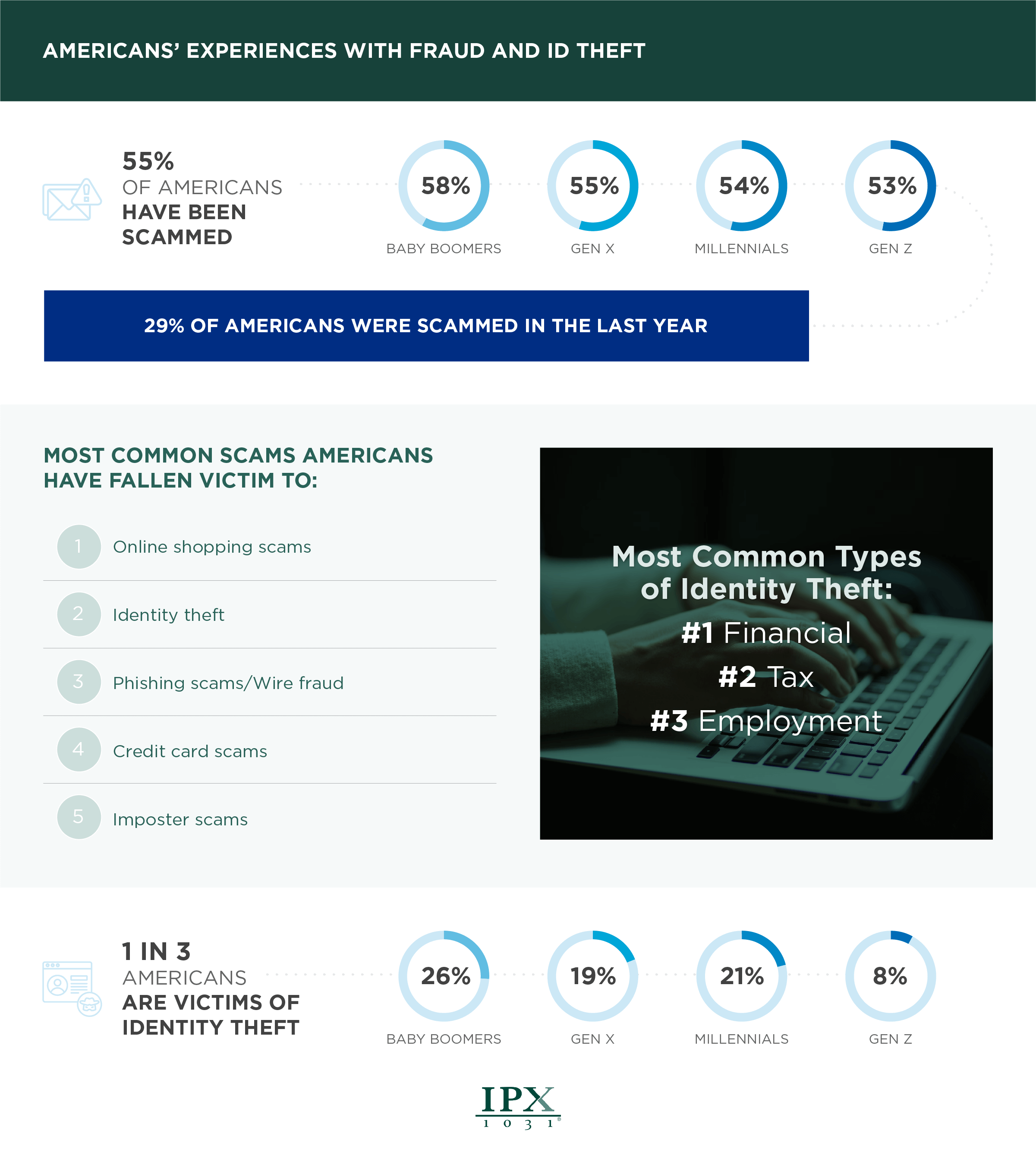

The majority of Americans (55%) have been scammed in their lifetimes. When analyzed by generation, Baby Boomers have the highest incidences (58%) of being scammed, followed by Gen X, Millennials, and Gen Z. In the last year alone, 29% of Americans report being scammed. The top 5 most common types of scams Americans have fallen for include:

- Online shopping scams

- Identity theft

- Phishing scams/wire fraud

- Credit card scams

- Imposter scams

Additionally, 1 in 3 Americans are victims of identity theft. More than 1 in 4 (26%) Baby Boomers have experienced this, followed by 21% of Millennials, 19% of Gen X, and 8% of Gen Z. Identity theft can happen in a variety of ways. The most common types Americans have fallen victim to include financial, tax, and employment identity theft.

Counting the Cost: The Financial Impact of Scams

Scams not only impact people emotionally, but also financially. In fact, 1 in 3 scam victims have lost money in the last 3 years. The average victim reports losing $1,500 to scams since 2020. To date, Americans have reported an average lifetime loss of $4,000.

The most common types of scams Americans are losing money to include online shopping, identity theft, and credit card scams. Despite the loss, nearly 2 in 5 scam victims didn’t submit reports. The top reasons why Americans didn’t take action include feeling like not enough money was lost to warrant a report, not being sure on how to report it, and feeling too embarrassed to come forward.

How Americans Are Safeguarding Themselves Against Scams

Although scams are becoming more sophisticated, there are steps you can take to protect your personal information from being stolen. The most common protective measures Americans are taking include increased scrutiny of emails and messages, enhanced password security, regularly monitoring bank and credit card statements, and educating themselves on the latest scam techniques.

However, not everyone is taking these steps. Nearly 3 in 4 change their banking passwords at least once a year, but 1 in 10 say they haven’t changed their financial passwords in more than five years. Another way to protect yourself, and your data, is using two-factor authentication. However, nearly 1 in 5 (17%) Americans don’t do that.

More than half (59%) of Americans are ‘somewhat’ confident in their ability to identify and avoid scams. That may be why 52% worry about falling for scams and 81% are worried about cyber security breaches of personal information.

Investment Property Exchange Services, Inc. (IPX1031) is the nation’s largest and most secure 1031 Qualified Intermediary. If you are considering a Tax Deferred 1031 Exchange for your investment property, it’s critical that the funds from your sale are protected. IPX1031 has the financial assurances, security and expertise essentials to protect your funds and provide answers and guidance throughout the exchange process. Learn more about IPX1031’s industry leading security and safety for exchangers and safeguards in place when selling and buying investment properties.

Methodology

In August 2023, we conducted a survey of 1,006 people from across the U.S. on their experiences with fraud and identity theft. Among respondents, 50% identified as male and 48% as female with an average age of 40.

For media inquiries, contact media@digitalthirdcoast.net

Fair Use

When using this data and research, please attribute by linking to this study and citing IPX1031.

Read more:

America’s Fraud and Identity Theft Reports by State 2023

Americans’ Experiences With Fraud and ID Theft

Your 1031 Funds Are Safe

Wire Fraud – Protect Your Business and Your Clients

Safety & Security for Exchangers

Take Steps to Combat 1031 Cyber Fraud

1031 Exchange and Defer? Or Sell and Pay Taxes?