Calculate Your 1031 Exchange Capital Gains Tax

Capital Gain Estimator

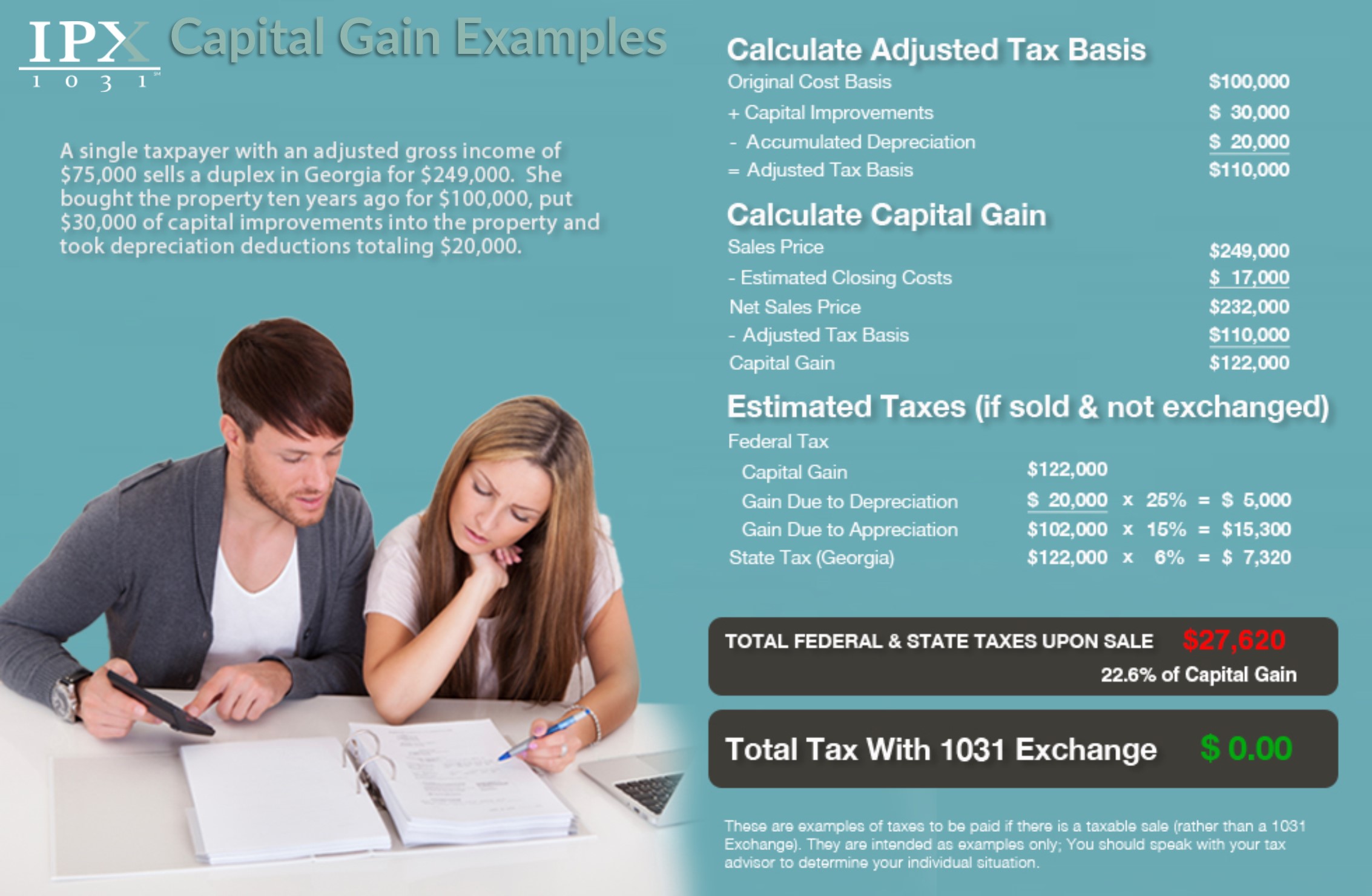

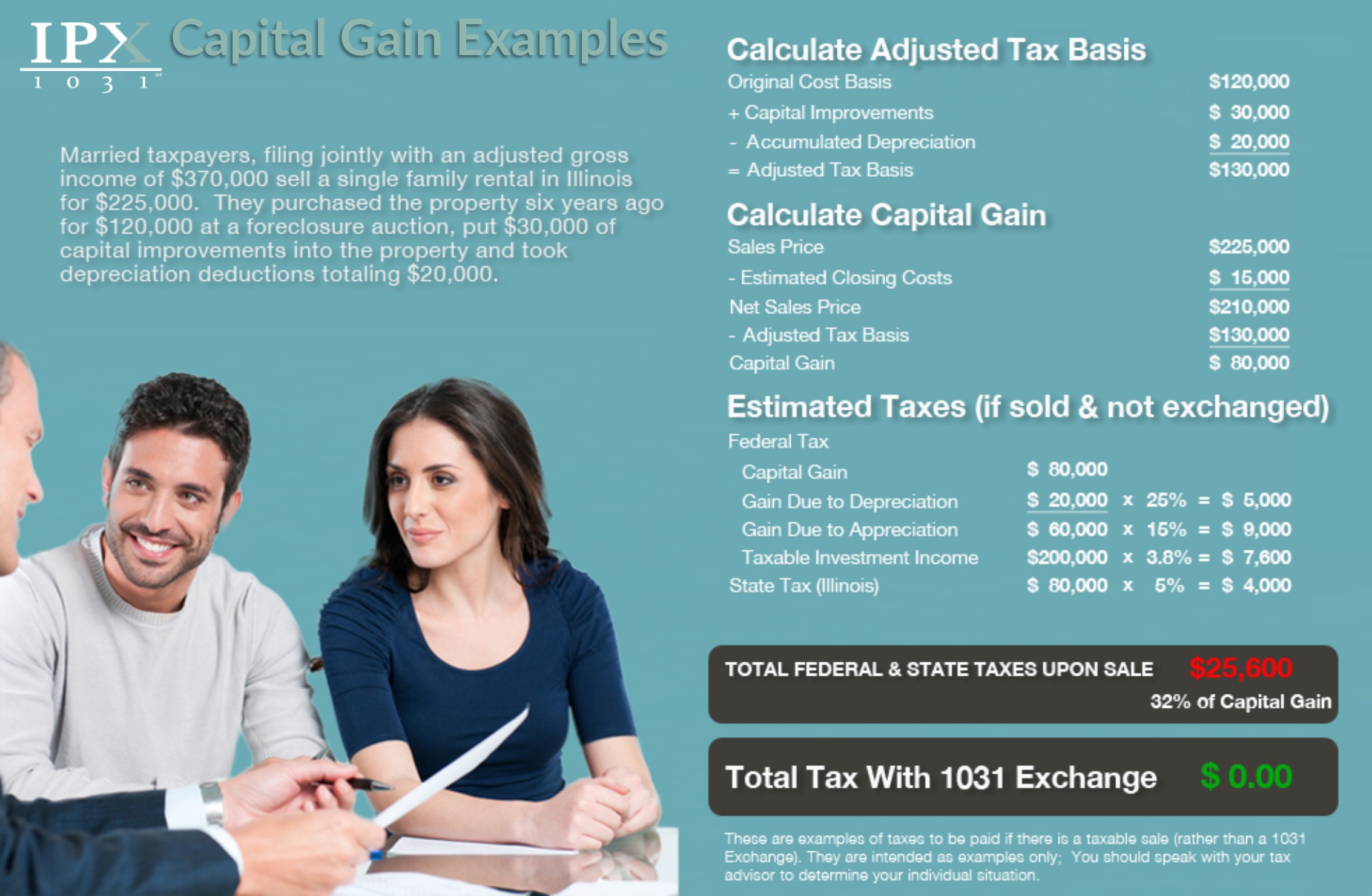

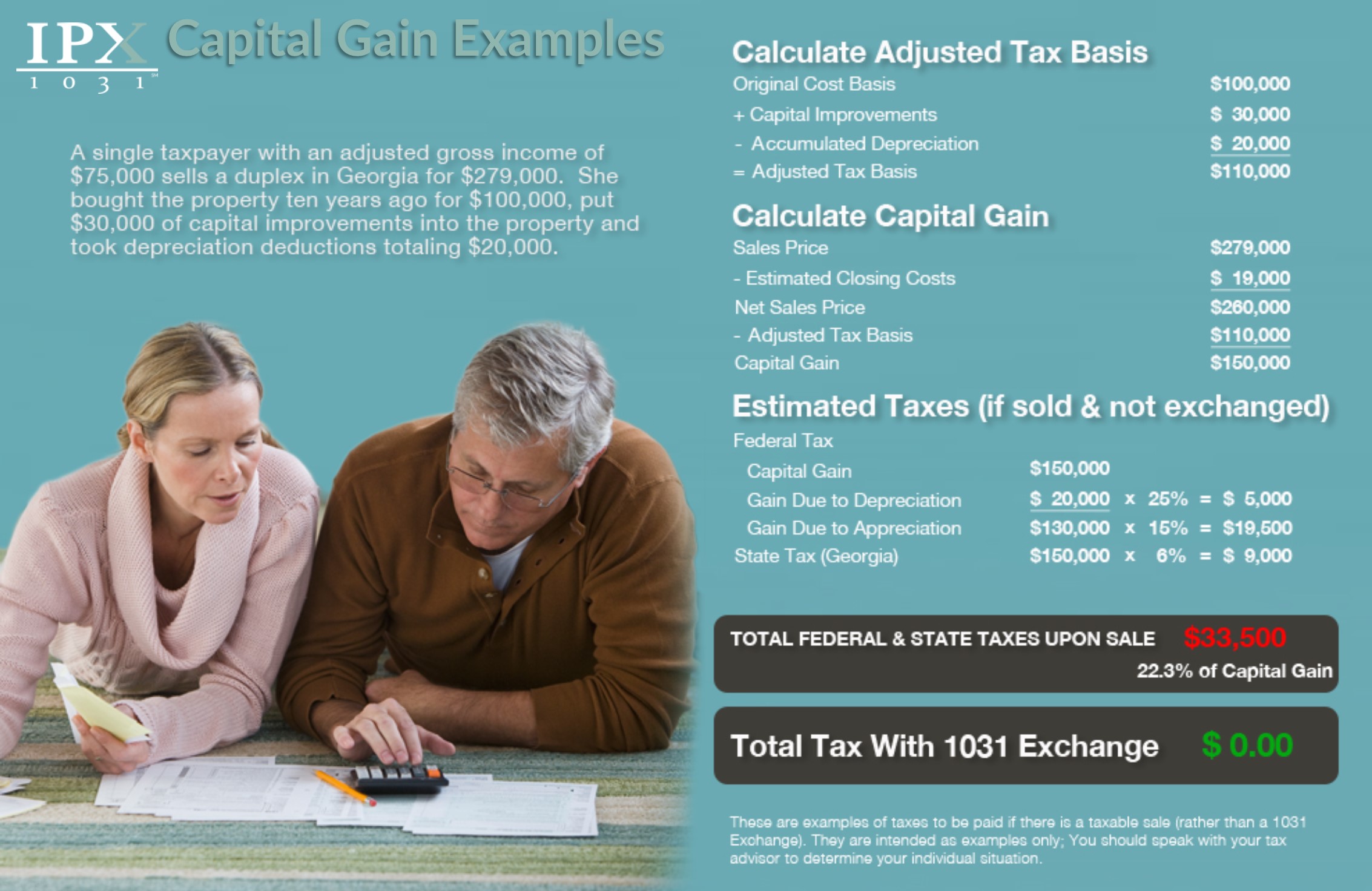

This Capital Gains Tax Calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 Exchange). This simplified estimator is for example purposes only. Since the calculation of taxes involves many factors and your individual situation may require additional variables not included in this illustration, speak to your tax or legal advisors. IPX1031 does not warrant or represent the accuracy of the calculations, answers or information provided.

The capital gain tax on appreciation in value goes up from 15% to 20% when “Taxable Income” exceeds $518,900 (single) or $583,750 (married filing jointly). (2024 amounts)

The Net Investment Income (NII) tax is applicable when the Taxpayer’s “Adjusted Gross Income” exceeds $200,000 for a single Taxpayer or $250,000 for married Taxpayers filing jointly. Read more on if this applies to you here.

See summary of 1031 vs taxable sale and 1031 Guidelines here.

1031 Exchange Capital Gain Examples

Does the NII (Net Investment Income Tax – Affordable Care Act) apply to you?

Effective January 1 2013, if an individual has income from investments, the individual may be subject to net investment income tax. Individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

The statutory threshold amounts are:

• Married filing jointly — $250,000,

• Married filing separately — $125,000,

• Single or head of household — $200,000, or

• Qualifying widow(er) with a child — $250,000

In general, net investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. Net investment income generally does not include wages, unemployment compensation, Social Security Benefits, alimony, and most self-employment income.

Additionally, net investment income does not include any gain on the sale of a personal residence that is excluded from gross income for regular income tax purposes. To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax.

If an individual owes the net investment income tax, the individual must file Form 8960. Form 8960 Instructions provide details on how to figure the amount of investment income subject to the tax.

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty.