What is a Reverse 1031 Exchange?

Parking Structures for Reverse and Improvement Exchanges

There are four main structures for parking arrangements. Three of the four structures require the EAT to step into the place of the Exchanger and acquire title to the replacement property. The fourth variation has the EAT acquire title to the relinquished property from the Exchanger. The two most common parking arrangements are illustrated below. All four structures along with detailed descriptions can be found here.

Replacement Property Parked Reverse Exchange

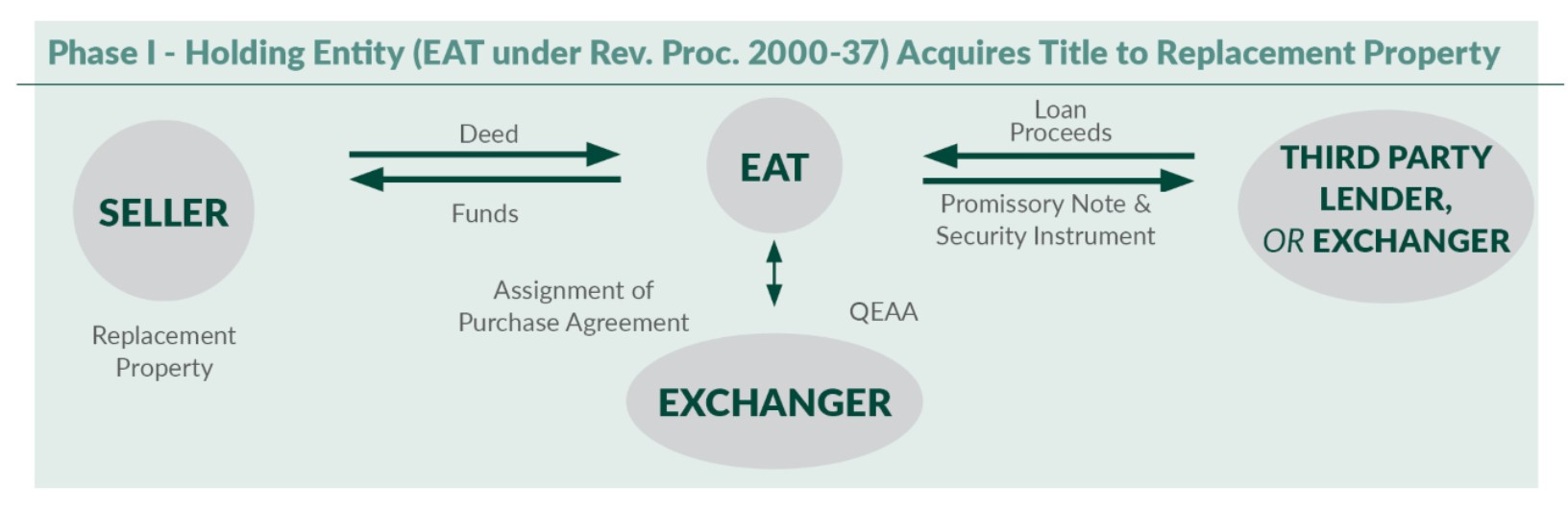

Replacement Property Parked – Phase I

In the most common type of reverse exchange, the EAT acquires and “parks” legal title to the Replacement Property. In the first phase of the reverse exchange, the Exchanger or a third party lender loans the funds necessary for the EAT to purchase and take title to the Replacement Property. The EAT leases the property to the Exchanger under a triple net lease. This permits the Exchanger to receive the economic benefits and burdens of the property during the time that it is held by the EAT.

Replacement Property Parked – Phase II

When the Exchanger sells the identified Relinquished Property, title is transferred directly to the buyer through direct deeding. The cash proceeds of the sale go to the Qualified Intermediary, which uses these Exchange Funds to acquire the Replacement Property from the EAT. Upon receipt, the EAT will first repay the loan from the Exchanger and then use remaining Exchange Funds to pay down the third-party loan on the Replacement Property prior to transferring the parked property to the Exchanger. If the Relinquished Property sale yields more Exchange Funds than necessary for the Qualified Intermediary to acquire the parked property, the Exchanger may identify additional Replacement Property within 45 days of the transfer of the Relinquished Property, and complete the additional acquisition within 180 days of the Relinquished Property transfer.

Replacement Property Parked – Loans to EAT

This type of reverse exchange works well when the Exchanger can pay all cash for the Replacement Property, when the seller is providing the financing, or when an Exchanger is working with a third-party commercial lender. If a loan from an institutional lender is required, the Exchanger should seek lender approval prior to beginning the reverse exchange because the EAT, as the titleholder of the property, may be required to be the borrower on the loan. Exchangers should be aware that many lenders are not familiar with reverse exchanges, many types of loans are not available when pursuing a reverse exchange, and the loan costs may be increased to cover the lender’s document preparation and legal fees. To protect the EAT from liability in the event of default by the Exchanger, the EAT will require the loan to be non-recourse as to itself. Lenders typically require the Exchanger to guarantee a loan made to the EAT.

Relinquished Property Parked Reverse Exchange

An alternative to parking the Replacement Property is to park the Exchanger’s Relinquished Property with the EAT.

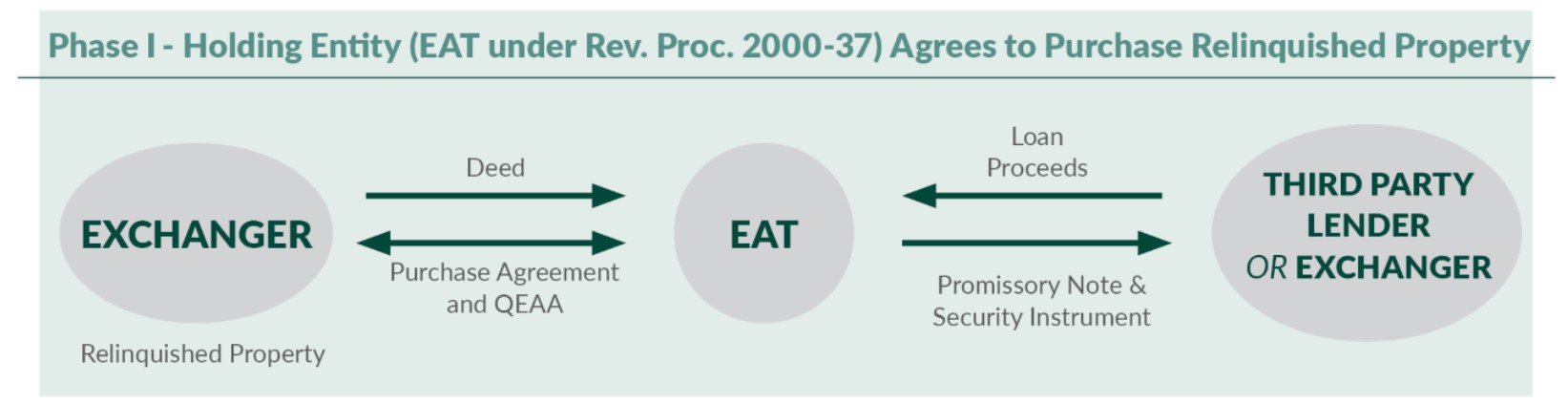

Relinquished Property Parked – Loans to EAT – Phase I

Since EAT does not have its own funds to purchase the Relinquished Property, it must borrow the money. Typically the consideration consists of (1) the EAT taking the Relinquished Property “subject to” the existing third-party financing, and (2) a purchase money loan from the Exchanger. For a fully deferred exchange, the loan from the Exchanger should equal the equity the Exchanger has in the Relinquished Property.

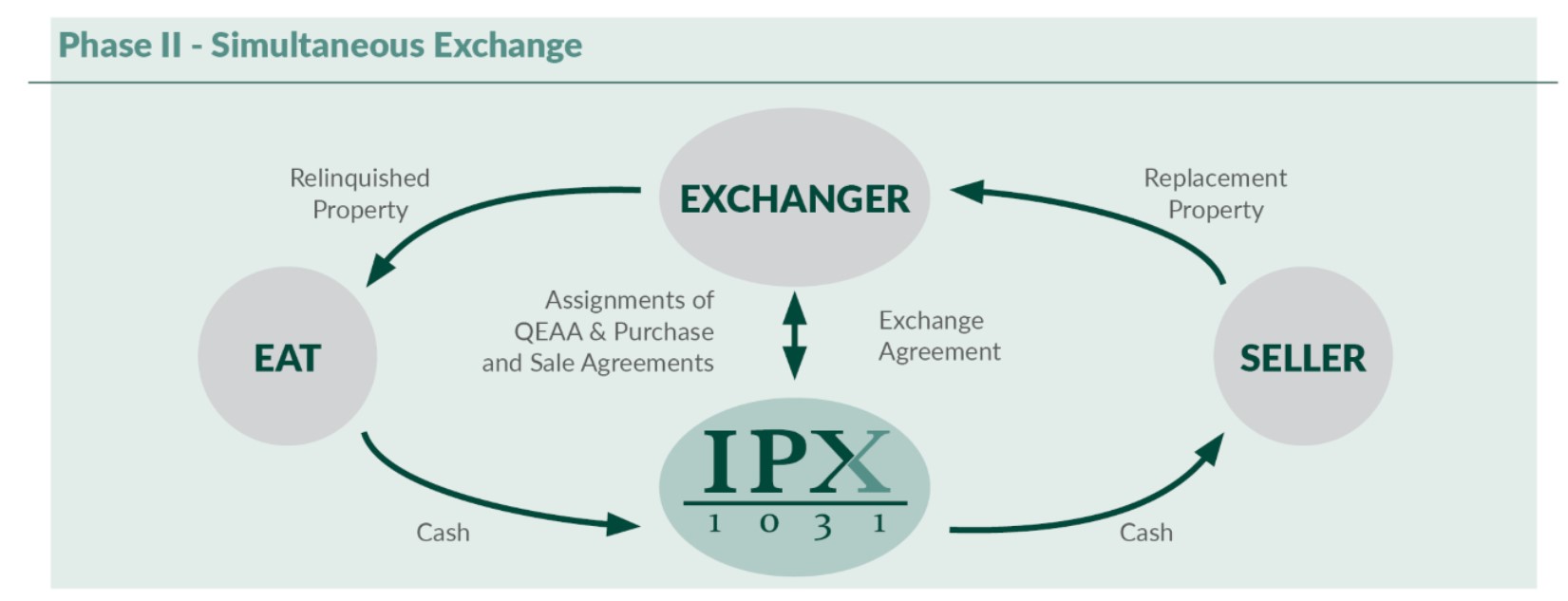

Relinquished Property Parked – Phase II

A Relinquished Property “parked” reverse exchange begins with a simultaneous exchange involving the Exchanger, the EAT, the seller of the Replacement Property, and the Qualified Intermediary. The Exchanger transfers the Relinquished Property to the EAT and simultaneously receives the Replacement Property from the seller. Both transfers occur through the Qualified Intermediary and the use of direct deeding. The funds EAT borrowed from Exchanger will be used to pay closing costs, with any balance flowing through the exchange and being applied toward the purchase of the Replacement Property.

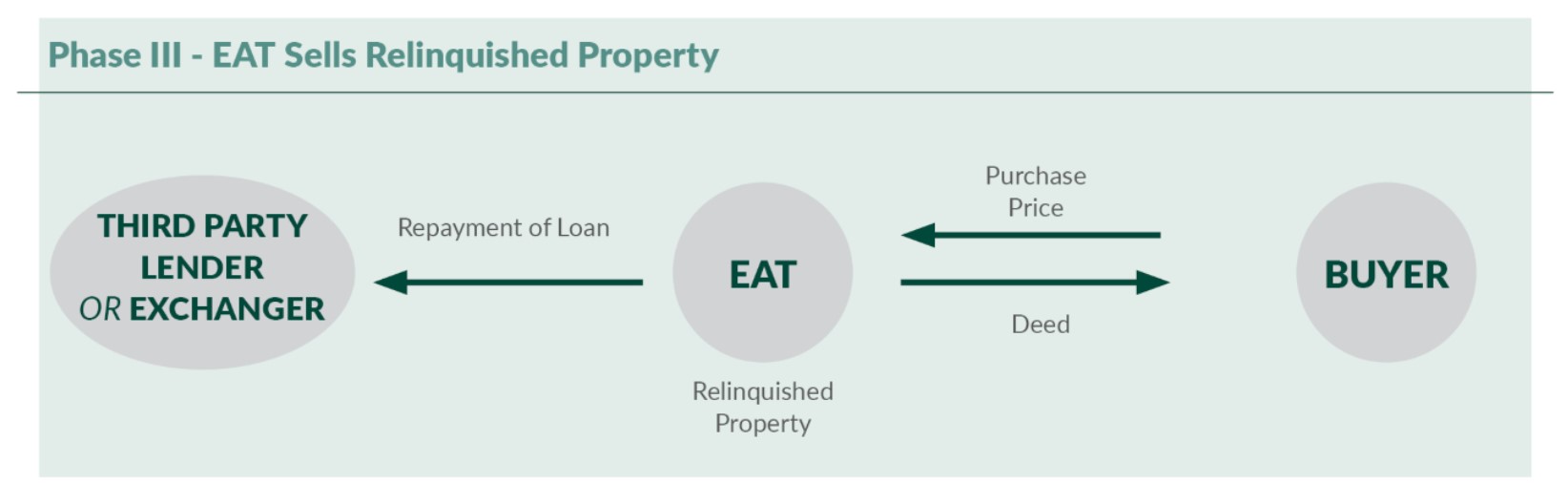

Relinquished Property Parked – Phase III

The cash proceeds from the sale of the Relinquished Property go to the EAT and are used first to retire any existing third-party debt the EAT took subject to, and then to repay the Exchanger for the original loan to the EAT. If the price paid by the EAT for the parked property differs from the actual price paid by the ultimate buyer, the Exchanger and the EAT will enter into a purchase price adjustment agreement to increase or decrease the original purchase price and loan amount from the Exchanger as necessary to reflect the final purchase price.

Reverse 1031 Exchange FAQs

Read more about Reverse and Improvement Exchange Frequently Asked Questions here.

There are four main structures for parking arrangements. Three of the four structures require the EAT to step into the place of the Exchanger and acquire title to the replacement property. The fourth variation has the EAT acquire title to the relinquished property from the Exchanger. The two most common parking arrangements are below. All four structures along with detailed images and descriptions can be found here.

Replacement Property Parked Reverse Exchange

Replacement Property Parked – Phase I

In the most common type of reverse exchange, the EAT acquires and “parks” legal title to the Replacement Property. In the first phase of the reverse exchange, the Exchanger or a third party lender loans the funds necessary for the EAT to purchase and take title to the Replacement Property. The EAT leases the property to the Exchanger under a triple net lease. This permits the Exchanger to receive the economic benefits and burdens of the property during the time that it is held by the EAT.

Replacement Property Parked – Phase II

When the Exchanger sells the identified Relinquished Property, title is transferred directly to the buyer through direct deeding. The cash proceeds of the sale go to the Qualified Intermediary, which uses these Exchange Funds to acquire the Replacement Property from the EAT. Upon receipt, the EAT will first repay the loan from the Exchanger and then use remaining Exchange Funds to pay down the third-party loan on the Replacement Property prior to transferring the parked property to the Exchanger. If the Relinquished Property sale yields more Exchange Funds than necessary for the Qualified Intermediary to acquire the parked property, the Exchanger may identify additional Replacement Property within 45 days of the transfer of the Relinquished Property, and complete the additional acquisition within 180 days of the Relinquished Property transfer.

Replacement Property Parked – Loans to EAT

This type of reverse exchange works well when the Exchanger can pay all cash for the Replacement Property, when the seller is providing the financing, or when an Exchanger is working with a third-party commercial lender. If a loan from an institutional lender is required, the Exchanger should seek lender approval prior to beginning the reverse exchange because the EAT, as the titleholder of the property, may be required to be the borrower on the loan. Exchangers should be aware that many lenders are not familiar with reverse exchanges, many types of loans are not available when pursuing a reverse exchange, and the loan costs may be increased to cover the lender’s document preparation and legal fees. To protect the EAT from liability in the event of default by the Exchanger, the EAT will require the loan to be non-recourse as to itself. Lenders typically require the Exchanger to guarantee a loan made to the EAT.

Relinquished Property Parked Reverse Exchange

An alternative to parking the Replacement Property is to park the Exchanger’s Relinquished Property with the EAT.

Relinquished Property Parked – Loans to EAT – Phase I

Since EAT does not have its own funds to purchase the Relinquished Property, it must borrow the money. Typically the consideration consists of (1) the EAT taking the Relinquished Property “subject to” the existing third-party financing, and (2) a purchase money loan from the Exchanger. For a fully deferred exchange, the loan from the Exchanger should equal the equity the Exchanger has in the Relinquished Property.

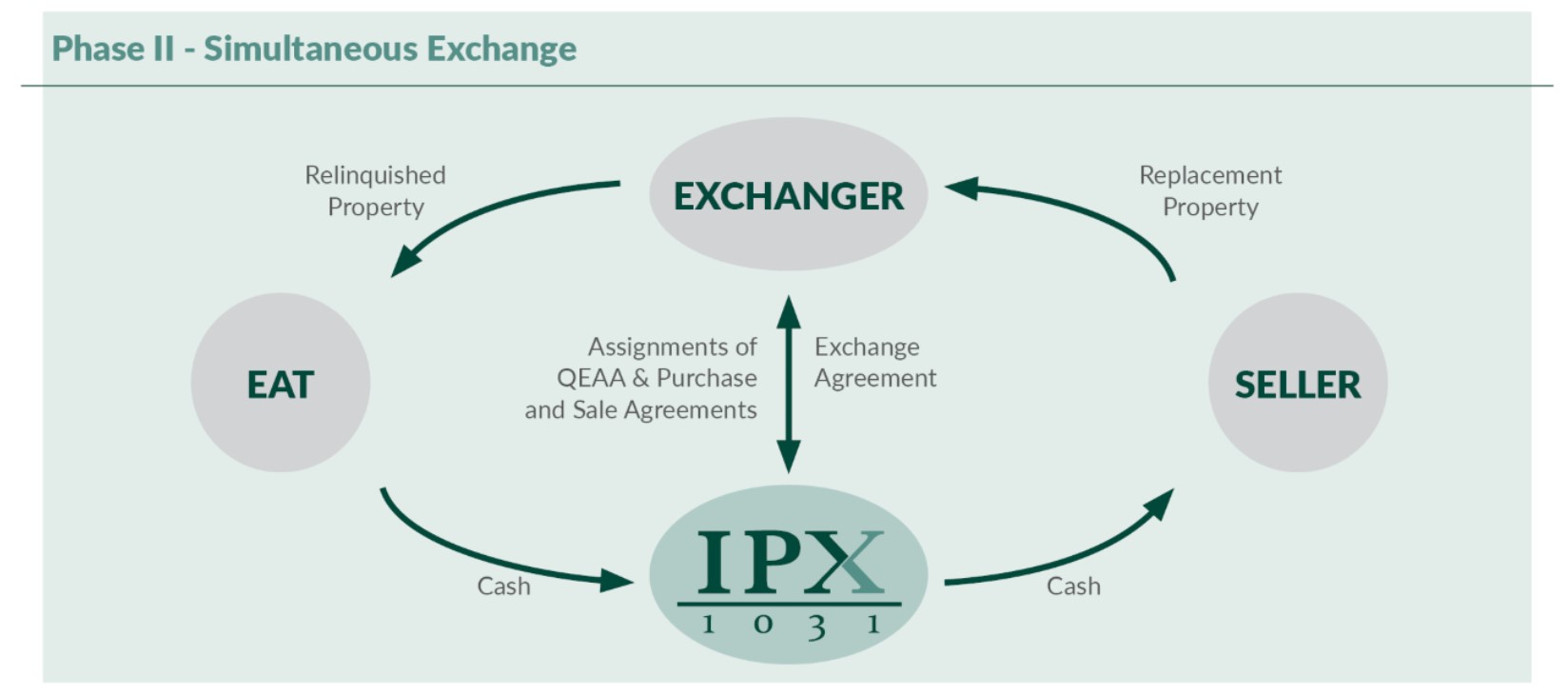

Relinquished Property Parked – Phase II

A Relinquished Property “parked” reverse exchange begins with a simultaneous exchange involving the Exchanger, the EAT, the seller of the Replacement Property, and the Qualified Intermediary. The Exchanger transfers the Relinquished Property to the EAT and simultaneously receives the Replacement Property from the seller. Both transfers occur through the Qualified Intermediary and the use of direct deeding. The funds EAT borrowed from Exchanger will be used to pay closing costs, with any balance flowing through the exchange and being applied toward the purchase of the Replacement Property.

Relinquished Property Parked – Phase III

The cash proceeds from the sale of the Relinquished Property go to the EAT and are used first to retire any existing third-party debt the EAT took subject to, and then to repay the Exchanger for the original loan to the EAT. If the price paid by the EAT for the parked property differs from the actual price paid by the ultimate buyer, the Exchanger and the EAT will enter into a purchase price adjustment agreement to increase or decrease the original purchase price and loan amount from the Exchanger as necessary to reflect the final purchase price.