If you are planning on purchasing property to complete your 1031 Exchange that requires improvements or perhaps you need to purchase land and construct a building, a Build-to-Suit Exchange may be your best strategy.

Build-to-Suit Exchange Guide Table of Contents

What is a Build-to-Suit Exchange?

Steps for Build-to-Suit Exchange

Timing in a Build-to-Suit Exchange

Identifying Property in a Build-to-Suit Exchange

How to Fully Defer Taxes in a Build-to-Suit Exchange

Who Manages a Build-to-Suit Exchange?

Is a Build-to-Suit Exchange for Me?

IPX1031 – Your Build-to-Suit 1031 Exchange Solution

Frequently Asked Questions

More Technical Information

What is a Build-to-Suit Exchange?

The Build-to-Suit Exchange, also called a “Construction” or “Improvement” Exchange, gives the Exchanger the opportunity to use the proceeds from the sale of the Relinquished Property (Exchange Funds) for new construction or renovations on the Replacement Property. If the value of the Replacement Property is less than that of the Relinquished Property, improvements can increase the value sufficiently to meet the “even or up” requirement to obtain full tax deferral.

Steps for Build-to-Suit Exchange

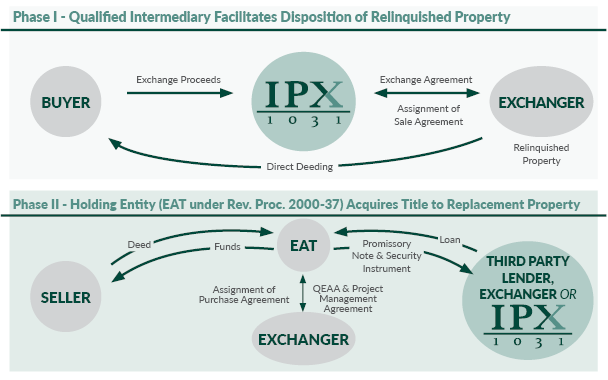

As part of the transaction, the Exchanger will sell the Relinquished Property through a Qualified Intermediary in a traditional Delayed Exchange. This step generally comes first, but in some situations the Replacement Property is acquired first through a parking arrangement. Prior to closing on the Replacement Property, the Exchanger must enter into a Qualified Exchange Accommodation Agreement (QEAA) with an Exchange Accommodation Titleholder (EAT) and assign its rights in the purchase contract to the EAT. The EAT then acquires (parks) the Replacement Property, using Exchange Funds, money from the Exchanger or a bank loan.

The use of an EAT to park title to the Replacement Property is necessary because (1) Section 1031 does not permit the Exchanger to own both the Relinquished and Replacement Properties at the same time; and (2) Exchange Funds cannot be used to improve property that the Exchanger already owns.

Timing in a Build-to-Suit Exchange

Managing the statutory time limits can be a little tricky. In the Delayed Exchange the Replacement Property must be identified within 45 days of the Relinquished Property sale and acquired by the Exchanger within 180 days. Pursuant to Rev. Proc. 2000-37 the EAT cannot hold the Replacement Property for more than 180 days.

If the Relinquished Property is sold first, that 180-day time limit will control. The Exchanger must acquire the parked Replacement Property by day 180 after the sale, even if the 180-day time limit for the parked property still has time to run.

Identifying Property in a Build-to-Suit Exchange

Unlike a Delayed Exchange, when it is part of a Build-to-Suit Exchange the identification of the Replacement Property must include not only a description of the underlying real estate, but also as much detail regarding the intended improvements as is practical.

How to Fully Defer Taxes in a Build-to-Suit Exchange

To fully defer taxes and avoid boot, at the time the Exchanger takes title the Replacement Property must have a value equal to or greater than the value of the Relinquished Property and all the exchange equity must have been invested. Any unused Exchange Funds may be taxable as boot. Only funds disbursed for material actually in place and services actually performed will count toward the exchange value. Improvements made to the Replacement Property after the Exchanger takes title cannot be included in the exchange value. Exchange Funds placed in escrow for post-closing improvements will not qualify even if the funds are deposited before the Exchanger takes title.

Who Manages a Build-to-Suit Exchange?

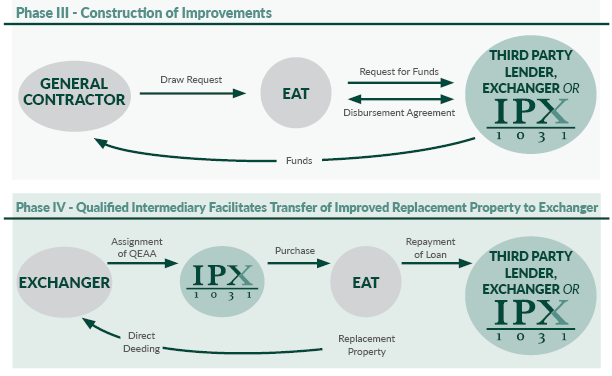

The Exchanger or its designated representative will act as the Project Manager to oversee all aspects of the construction, including sending invoices to the EAT for payment. The EAT must make payments directly to the vendors. During the exchange period the Exchanger cannot be reimbursed for any expenses it incurs or advances.

If the Exchange Funds are not sufficient to complete the acquisition and improvement of the Replacement Property, additional funds can be loaned to the EAT by the Exchanger. If a loan from an institutional lender is required, the Exchanger should seek lender approval prior to beginning the exchange. Some lenders will not allow the EAT to be the borrower on the loan. The EAT will require the loan be non-recourse as to itself. Lenders typically require the Exchanger to guarantee a loan made to the EAT.

At the end of the Exchange, the Replacement Property is often transferred to the Exchanger by assignment of the sole membership interest in the holding entity rather than by a deed. Selecting the appropriate method for transfer of title should be determined after review of transfer tax and other legal issues by the Exchanger’s tax and legal advisors. If a third-party lender is involved, the Exchanger will assume the loan upon the conclusion of the exchange.

Is a Build-to-Suit Exchange for Me?

A Build-to-Suit Exchange is an excellent way to utilize tax deferred dollars to build exchange value. Because construction timelines can be difficult to control, this type of 1031 Exchange requires careful planning. Please contact one of the Exchange Experts at IPX1031 to set up your next Build-to-Suit Exchange.

IPX1031 – Your Build-to-Suit 1031 Exchange Solution

Regardless of the type of 1031 Exchange you need, our IPX1031 specialists are standing by to help make your transaction a smooth process. For more details, read Planning Ahead for a Successful Exchange and How to Initiate a Reverse Exchange. As with all investments and wealth maintaining strategies, you should seek the advice of your own legal and tax advisors for your specific situation. IPX1031 is the largest national qualified intermediary providing a full suite of services. IPX1031 also has the largest and most experienced Reverse and Improvement Exchange division in the country specializing in transactions REITS, life insurance companies, businesses, and individual investors. Contact IPX1031 to discuss your 1031 Exchange solution.

Read More

Reverse and Improvement Exchange Frequently Asked Questions

Combination Exchanges

Reverse & Improvement brochure

Reverse book

Why are Reverse 1031 Exchanges More Complicated?

Capital Gains Estimator

IPX1031 Knowledge Center

Build-to-Suit Frequently Asked Questions

Can you use a 1031 Exchange for new construction?

Yes. When properly structured, you can use proceeds from the sale of the Relinquished Property to construct/improve the Replacement Property. You will need an Accommodator to hold title to the Replacement Property while the improvements are made.

Can I use 1031 Exchange to pay off the mortgage on another property?

No. Section 1031 requires the exchange of “like kind” properties. The payment of a debt is not like kind to the real estate that was sold.

Can a 1031 Exchange be used for renovations?

When properly structured, 1031 Exchange proceeds from the sale of the Relinquished Property can be used for renovations to the Replacement Property. You will need an Accommodator to hold title to the Replacement Property while the renovations are made.

For more technical information, please read more in-depth and detailed information below:

The Build-to-Suit Exchange, also referred to as a Construction Exchange or Improvement Exchange, gives the Exchanger the opportunity to use Exchange Funds for construction, renovations or new improvements, to the Replacement Property. In the most common type of Build-to-Suit Exchange, the Exchanger sells the Relinquished Property through a Qualified Intermediary in a Delayed Exchange, and then acquires the Replacement Property after it has been improved using the Exchange Funds from the Relinquished Property sale. Note that any improvements made to the Replacement Property after the Exchanger takes title are not considered “like-kind”. Treas. Reg. §1.1031(k)-1(e). To qualify for inclusion in the exchange, any improvements to the property must occur before the Exchanger takes title. Bloomington Coca-Cola Bottling Company v. Commissioner, 189 F.2d 14 (CA7 1951). Any unused Exchange Funds may be taxable as boot. Only funds disbursed for material actually in place and services actually performed will count toward the exchange value. Exchange Funds in an escrow “holdback” for post-closing improvements will not qualify even if the funds are deposited before the Exchanger takes title.

If the Exchanger wishes to include construction on the Replacement Property as part of the exchange, one option is to contract with the seller to have the construction completed before the transaction closes and the Exchanger takes title to the property. For a variety of reasons, this is often not a viable option. Rev. Proc. 2000-37 provides a “safe harbor” for structuring a Build-to-Suit Exchange using an Exchange Accommodation Titleholder (EAT) to hold title to the Replacement Property pending completion of the improvements. Time limitations and all other rules of IRC §1031 apply to Build-to-Suit Exchanges. The Identification Notice in a Build-To-Suit Exchange should include a description of the underlying real estate and as much detail regarding the improvements as is practical. To avoid boot, the Exchanger must ultimately acquire Replacement Property with a value equal to or greater than the value of the Relinquished Property, and use all of the exchange equity in the acquisition of the improved Replacement Property.

As in a typical Delayed Exchange, the Build-to-Suit Exchange involves a Qualified Intermediary and begins when the Exchanger sells the Relinquished Property. Prior to closing on the purchase of the Replacement Property, the Exchanger enters into a Qualified Exchange Accommodation Agreement (QEAA) with the EAT and assigns its rights in the purchase contract to the EAT. The EAT then acquires title to the Replacement Property. IPX1031 holds all parked properties in a separate special purpose holding entity (typically a single member LLC) for each exchange (the EAT and holding entity are jointly referred to as the EAT). The Exchanger or its designated representative is authorized by the EAT to act as its project manager to oversee all aspects of the construction. During the 180-day exchange period, the Exchanger, as project manager, sends construction invoices to the EAT for payment. The EAT must make payments directly to the vendors.

Build-to-Suit Exchanges are less complicated when the improvements can be paid for with cash loaned to the EAT by the Exchanger or with Exchange Funds advanced by the Qualified Intermediary. If a construction loan from an institutional lender is required, the Exchanger should seek lender approval prior to beginning the exchange, since the EAT, as titleholder to the Replacement Property, may be required to be the “borrower” on the loan. To protect the EAT from liability in the event of default by the Exchanger, the EAT will require the loan to be non-recourse as to itself. Lenders typically require the Exchanger to guarantee a loan made to the EAT.

On the earlier of the end of the 180-day Exchange Period or completion of construction on the Replacement Property, the EAT will transfer the Replacement Property to the Exchanger to complete the exchange. Depending upon the Exchanger’s preference, the Replacement Property is often transferred to the Exchanger by assignment of the sole membership interest in the holding entity rather than by a deed. Selecting the appropriate method for transfer of title should be determined after review of transfer tax and other legal issues by the Exchanger’s tax and legal advisors. If a third party lender is involved, the Exchanger typically will assume the construction loan upon the conclusion of the exchange. Any construction to be included in the exchange must be completed and paid for prior to the holding entity’s transfer of the Replacement Property to the Exchanger.

Rev. Proc. 2000-37 also permits the Exchanger to use an EAT to close on the purchase of the Replacement Property and commence construction of improvements, prior to the sale of the Relinquished Property. In Reverse Build-to-Suit Exchanges, since the Relinquished Property has not yet sold, the Exchanger or a third-party lender must loan funds to the holding entity to acquire and improve the Replacement Property.

A New Construction 1031 Exchange is an excellent way to utilize tax deferred dollars to build exchange value. When the taxpayer wishes to use funds from the sale of a property towards new construction, they must retain an Exchange Accommodation Titleholder (EAT), whose role is to hold the title of the land on which construction is to be done. The reason is that the taxpayer cannot own the new land until the end of the exchange period. There are several stringent time limits: First, there is the 45-day identification period between the sale of the old property and the purchase of the new to identify the Replacement Property and the proposed improvements; additionally, the title can only be held by the EAT for up to 180 days. To obtain maximum tax deferral the value of the new property at end of construction must be equal to or greater than the value of the original property that was sold. Because construction timelines can be difficult to control, this type of 1031 Exchange requires careful planning.