Delayed Exchanges

Most common 1031 Exchange?

The most common type of 1031 Exchange is the Delayed/Forward Exchange. This allows taxpayers to sell investment property and then replace it, tax deferred, with new investment property. In general, any type of U.S. real property held for productive use in a trade or business, or for investment purposes can be exchanged for more real property as long as the properties are of “like-kind”, regardless of grade or quality.

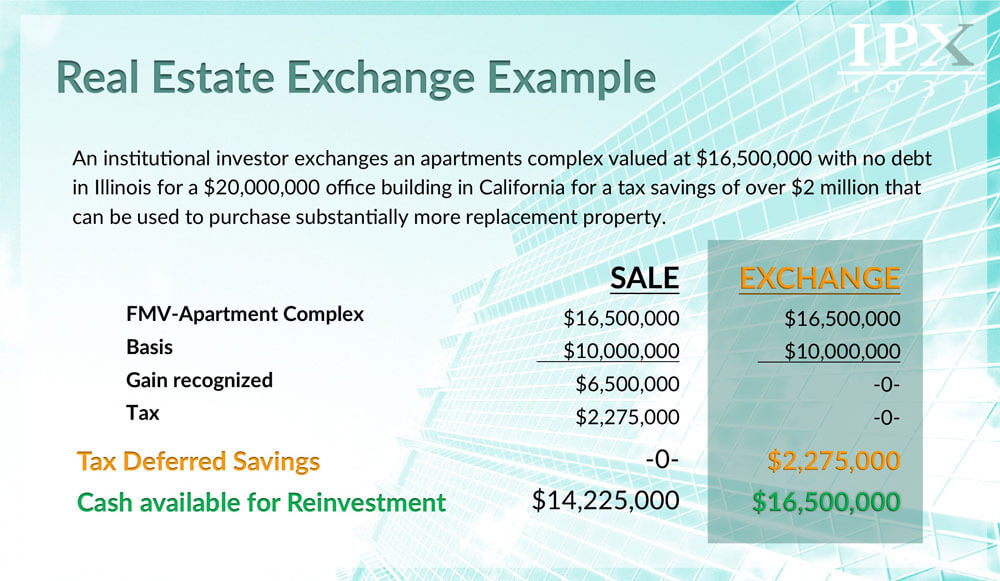

Many investors like to see what kind of tax savings they can benefit from when they sell their investment property. Above is an example which outlines the sale of an apartment building and a purchase of an office building with and without the use of a 1031 Exchange. As you can see, when using the 1031 Exchange, the investor benefits from a significant tax deferral.

1031 Exchange Deadlines & Rules

There are two key deadlines that the Exchanger must meet to have a valid exchange:

- Identification Period: Within 45 calendar days of the transfer of the first Relinquished Property, the Exchanger must identify the Replacement Property to be acquired.

- Exchange Period: The Exchanger must receive the Replacement Property within the earlier of 180 calendar days after the date on which the Exchanger transferred the first Relinquished Property, or the due date (including extensions) for the Exchanger’s tax return for the tax year in which the transfer of the first Relinquished Property occurs.

- The time periods for the 45-day Identification Period and the 180-day Exchange Period are very strict and cannot be extended even if the 45th day or 180th day falls on a Saturday, Sunday or legal holiday. They may, however, be extended by up to 120 days if the Exchanger qualifies for a disaster extension under Rev. Proc. 2007-56.

- Read more on How to identify Replacement Property here

- Read more on Requirements for a Proper Identification Notice here

Exchangers have flexibility to identify multiple and alternate Replacement Properties.

- Three Property Rule: The Exchanger may identify as potential Replacement Property any three properties, without regard to their fair market value.

- 200% Rule: The Exchanger may identify as potential Replacement Property any number of properties, provided the aggregate fair market value (as of the end of the Identification Period) of all of the identified properties does not exceed 200% of the aggregate fair market value of all of the Relinquished Properties.

- 95% Exception: If the Exchanger identifies more potential Replacement Properties than allowed under either the Three Property or the 200% Rules, the Exchanger will be treated as if no Replacement Property was identified unless the Exchanger actually receives Replacement Property by the end of the Exchange Period worth at least 95% of the aggregate fair market value of all of the identified Replacement Properties. For this purpose, fair market value of the aggregate Replacement Property is determined as of the earlier of the date the property is received by the Exchanger or the last day of the Exchange Period.