Coming out of a global pandemic and rising interest rates have not hindered the positive outlook of the CRE industry. Last year saw a record number of 1031 Exchanges, and halfway through 2022, transactions remain robust. If you are considering the sale of investment property, rather than a tax liability of up to 40%, you may utilize a 1031 Exchange to defer the following taxes:

- Capital Gains – Your rate will vary based on your taxable income . For 2024, your rate may be 20% if taxable income exceeds $518,900 (single) or $583,750 (married filing jointly).

- Net Investment Income Tax (NIIT) – If you have income from investments, including capital gains, you may be subject to a 3.8% net investment income tax on your adjusted gross income in excess of $200,000 ($250,000 if married filing jointly). Read more to see if this applies to you.

- State tax –You may be subject to state or local income taxes. State tax rates vary from 0% to the highest rate in California at 13.3%. See 2024 rates here.

- Depreciation Recapture – A flat Federal tax rate of 25% is applied for unrecognized gain due to depreciation.

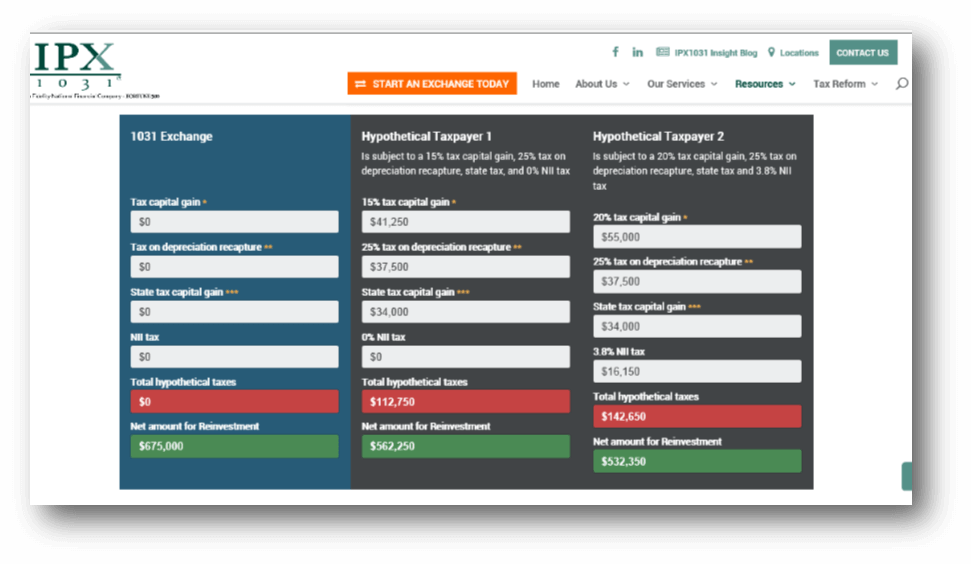

Capital Gain Estimator

Use our Capital Gain Estimator tool that illustrates potential taxes to be paid in a taxable sale vs. a 1031 Exchange.

Tax and Legal Advisors

The calculation of taxes involves many factors and your individual situation may require additional variables. Speak to your tax or legal advisors.

IPX1031. The best choice for your 1031.

Investment Property Exchange Services, Inc. (IPX1031) is the largest and one of the oldest Qualified Intermediaries in the United States. As a wholly owned subsidiary of Fidelity National Financial (NYSE:FNF), a Fortune 500 company, IPX1031 provides industry leading security for your exchange funds as well as considerable expertise and experience in facilitating all types of 1031 Exchanges. Taxpayers’ funds are held in segregated accounts using the Exchanger’s taxpayer identification number. Our nationwide staff, which includes industry experts, veteran attorneys, and accountants, are available to assist your legal and tax advisors. For additional information regarding IPX1031 and questions on 1031 Exchanges, please review:

Capital Gains Estimator

Opportunities of the 1031 Exchange

1031 vs Paying Tax & 1031 Guidelines

Does NIIT Tax Apply to You?

What is a 1031 Exchange?

IPX1031 Knowledge Center