Virginia, West Virginia & Florida

Claudia is located in IPX1031’s St. Augustine office and she manages the Southern and Southeastern regions.

Rules & Timelines – IPX1031

IPX1031 offers you a comprehensive guide on how to do 1031 Exchanges in Florida, with insights into tax-deferral benefits, rules, and strategies for real estate investment property.

Investors can defer capital gains taxes on Florida real estate investment sales via IRC Section 1031. 1031 Exchanges are part of the Federal Tax Code, and Florida recognizes 1031 Exchanges for real estate transactions. Florida follows all federal 1031 Exchange rules, regulations and timelines allowing investors to defer capital gains on the sale of qualified property if exchanged for like-kind property.

There are many great investment opportunities for tax deferral in Florida. We see many investors using 1031 Exchanges for property such as short term rental vacation properties, retail, mixed use, multifamily and more. If you considering a Florida 1031 Exchange, reach our to our Florida 1031 experts at IPX1031 for any questions or to get started.

1031 Exchanges in Florida allows an investor to sell investment property, reinvest the proceeds in new investment property, and defer capital gain and other taxes associated with the sale, as long as all rules and regulations are followed.

As a general rule of thumb, to avoid paying any capital gain taxes in any Florida exchange, the investor should always attempt to: 1) purchase equal or greater in value 2) reinvest all of the equity in the Replacement Property and 3) obtain equal or greater debt on the Replacement Property.

To qualify as a 1031 Exchange, the Relinquished and Replacement Properties must be qualified “like-kind” properties and the transaction must be properly structured as an exchange. “Like-kind” Relinquished Property and Replacement Properties must be real property that has been and will be held for productive use in the investor’s trade or business or for investment. Examples of popular like-kind property in Florida may be hotels, storage facilities, qualifying rental vacation property, nursing homes, strip malls, golf courses, office buildings and parking lots.

Hotels & Hospitality

Multifamily

Agriculture

Industrial

Rental & Vacation Homes

Retail

Mixed Use

Commercial

A 1031 Exchange transaction in Florida, like every 1031 Exchange transaction nationwide, requires planning, expertise and support. Here’s a checklist outlining key steps in your exchange:

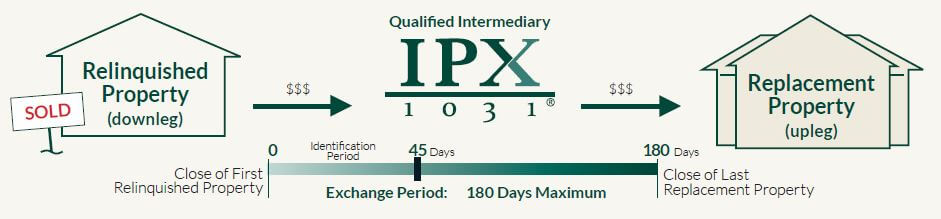

For your 1031 Exchange in Florida here are the key things you need to know – from the timeline process, deadlines, and other requirements:

IPX1031 is your expert Florida Qualified Intermediary, serving Florida and additionally offering Qualified Intermediary service in all states nationwide. A Qualified Intermediary will hold your exchange funds, creates the exchange of properties and prepares all exchange documents.

Your Qualified Intermediary is critical to your exchange and your choice of a Qualified Intermediary should not be taken lightly. When choosing a Qualified Intermediary, the two most critical factors for evaluation are safety and security of exchange funds and competency of staff. Financial Assurances for your funds, Safety and Security for the transfer of your funds, Reputation, Expertise and Strength are all critical.

Keep in mind ‘who’ can act as your Qualified Intermediary. Anyone who has acted as your employee, attorney, accountant, investment banker or broker, or real estate agent or broker within the two year period before the date of the transfer of the Relinquished Property is disqualified from being a Qualified Intermediary.

Also, your Qualified Intermediary cannot provide tax or legal advice. Always talk to your legal and tax advisors to determine what is best for your individual situation.

IPX1031 will work with you and can consult with your team of advisors below.

Attorneys

Tax Advisors

Realtors

Financial Planners

Commercial Brokers

CPAs

Title/Escrow/Settlement Agents

Lenders

Customized solutions for your 1031 investment and business goals.

IPX1031, the national leader in 1031 Exchange QI services, is pleased to offer service in all cities, counties, and areas throughout Florida, including:

Is there an IPX1031 office near me? IPX1031, the national leader in 1031 Exchange QI services, is pleased to offer service in all US states including Alabama, Alaska, Arizona, Arkansas, Northern California, Southern California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming Search for your closest 1031 agent and 1031 office location here.