Southern and Central California.

With over 20 years of experience, Greg is an expert in Delayed, Simultaneous, Reverse and Improvement Exchanges and provides nationwide services to his clients.

Rules & Timelines – IPX1031

IPX1031 provides an in-depth guide to navigating 1031 Exchanges in California, offering valuable insights into tax-deferral benefits, regulations, and effective strategies for real estate investment.

Investors can defer capital gains taxes on California real estate investment sales through IRC Section 1031. 1031 Exchanges are federally recognized, and California adheres to federal rules, regulations, and timelines, enabling investors to defer capital gains on qualified property exchanges.

California offers diverse investment opportunities for tax deferral, including properties like short-term rental vacation properties, retail spaces, mixed-use developments, and more. If you’re exploring a California 1031 Exchange, consult with the experts at IPX1031 for guidance and support.

If you own California real estate and are planning on deferring taxes when you sell your investment by purchasing property in another State via a 1031 Exchange, be aware of the California Clawback. Learn more about it here.

1031 Exchanges in California empower investors to sell investment property, reinvest proceeds in new investment property, and defer capital gain and other taxes, provided all rules and regulations are followed.

To minimize capital gain taxes in any California exchange, investors should strive to: 1) purchase property of equal or greater value, 2) reinvest all equity in the Replacement Property, and 3) secure equal or greater debt on the Replacement Property.

To qualify for a 1031 Exchange, Relinquished and Replacement Properties must be qualified as “like-kind,” and the transaction must be structured properly. “Like-kind” properties must be real property held for productive use in the investor’s trade or business or for investment.

Popular like-kind property options in California include hotels, storage facilities, rental vacation properties, nursing homes, strip malls, golf courses, office buildings, and parking lots.

Hotels & Hospitality

Multifamily

Agriculture

Industrial

Rental & Vacation Homes

Retail

Mixed Use

Commercial

Executing a 1031 Exchange in California, like anywhere else, demands meticulous planning, expertise, and support. Here’s a checklist outlining key steps in your exchange:

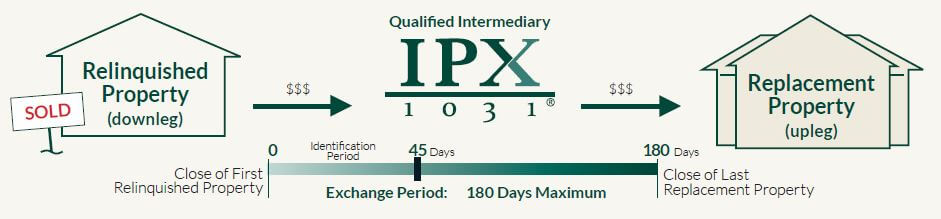

For your 1031 Exchange in California, here’s what you need to know about the timeline process, deadlines, and other requirements:

IPX1031 is your trusted California Qualified Intermediary, serving California and providing Qualified Intermediary services nationwide. Your choice of Qualified Intermediary is crucial for your exchange’s success, focusing on factors like the safety and security of exchange funds and the competence of staff.

IPX1031 offers financial assurances, security for fund transfers, and a strong reputation, ensuring a smooth exchange process. Remember that individuals disqualified from acting as Qualified Intermediaries include those who have served as your employee, attorney, accountant, investment banker or broker, or real estate agent or broker within the two-year period before the Relinquished Property transfer date.

Additionally, Qualified Intermediaries cannot offer tax or legal advice, so always consult with your legal and tax advisors for personalized guidance.

IPX1031 collaborates with your team of advisors to ensure seamless exchanges.

Attorneys

Tax Advisors

Realtors

Financial Planners

Commercial Brokers

CPAs

Title/Escrow/Settlement Agents

Lenders

Customized solutions for your 1031 investment and business goals.

IPX1031, the national leader in 1031 Exchange QI services, is pleased to offer service in all cities, counties, and areas throughout California, including:

Is there an IPX1031 office near me? IPX1031, the national leader in 1031 Exchange QI services, is pleased to offer service in all US states including Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming Search for your closest 1031 agent and 1031 office location here.