For the latest data on tiny homes, check out our 2024 report.

Throughout the last several years, the market for tiny homes has seen big growth. The pandemic accelerated the demand for this unique way of living as both first-time homebuyers and property investors have been attracted to the affordability and flexibility that tiny living provides.

But where is the best place to find and live in a tiny home? We crunched the numbers on tiny home prices across the country as well as cost of living, median income and other factors to determine the most ideal states for tiny homes.

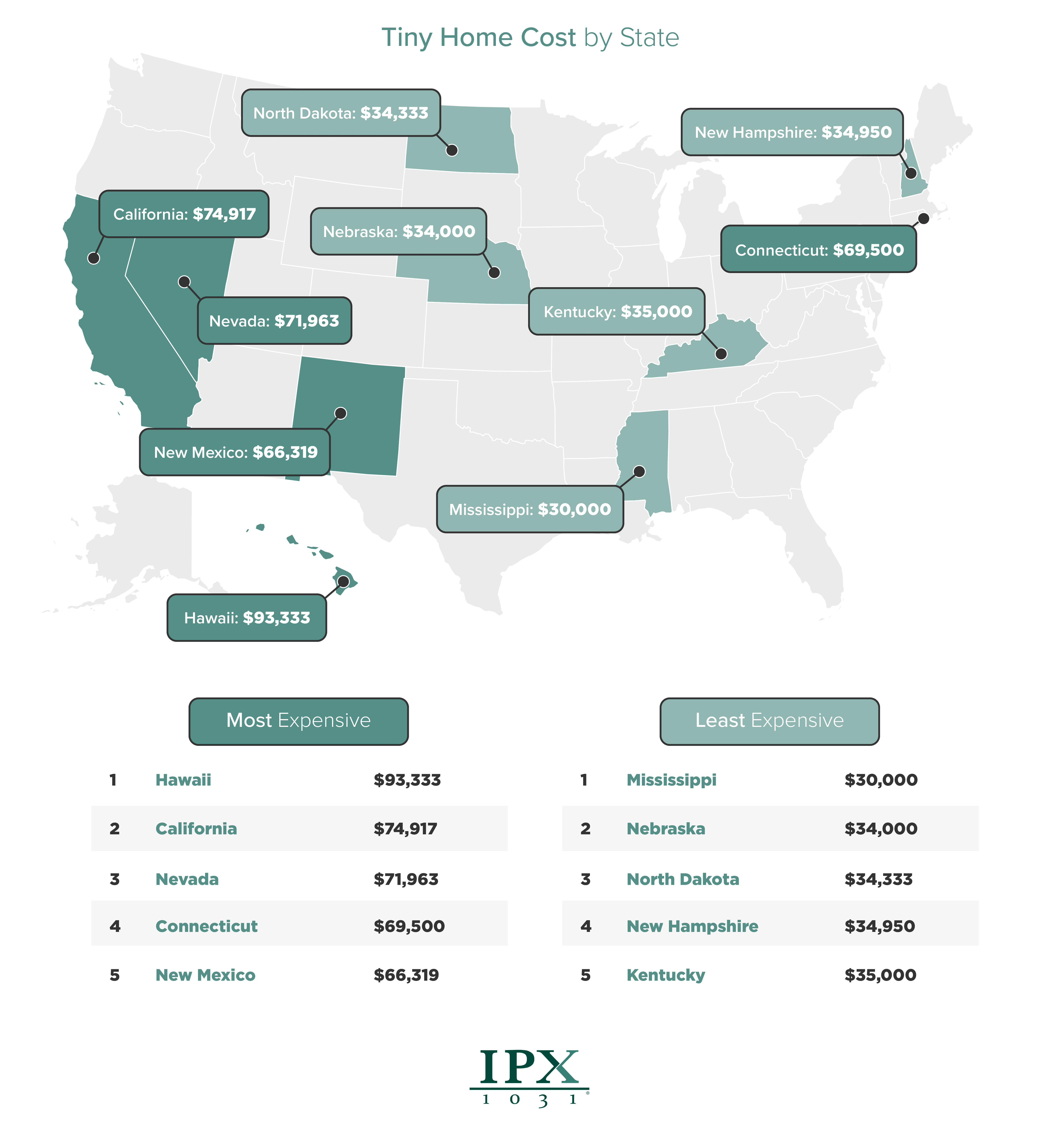

Tiny Home Cost by State

Before we jump into our rankings of the best states for tiny homes, let’s take a look at how affordable tiny homes are across the country.

The affordability of a tiny home is one of the biggest draws to home buyers. Most tiny homes cost between $30,000 to $60,000 while the median price for a starter home is $233,400, according to the National Association of Realtors.

After analyzing tiny home listing data, we found that Mississippi is the most affordable state to buy a tiny home ($30,000). The state is also one of the most affordable places to buy a traditional home, according to Zillow. Nebraska ranks second with the average tiny home cost coming in around $34,000, followed by North Dakota ($34,333), New Hampshire ($34,950) and Kentucky $35,000.

In terms of states with the most expensive tiny homes, you’d have to look west – way west – at Hawaii, where tiny home prices average around $93,333. California ($74,917) is the second most expensive state for tiny homes, followed by Nevada ($71,963), Connecticut ($69,500) and New Mexico ($66,319).

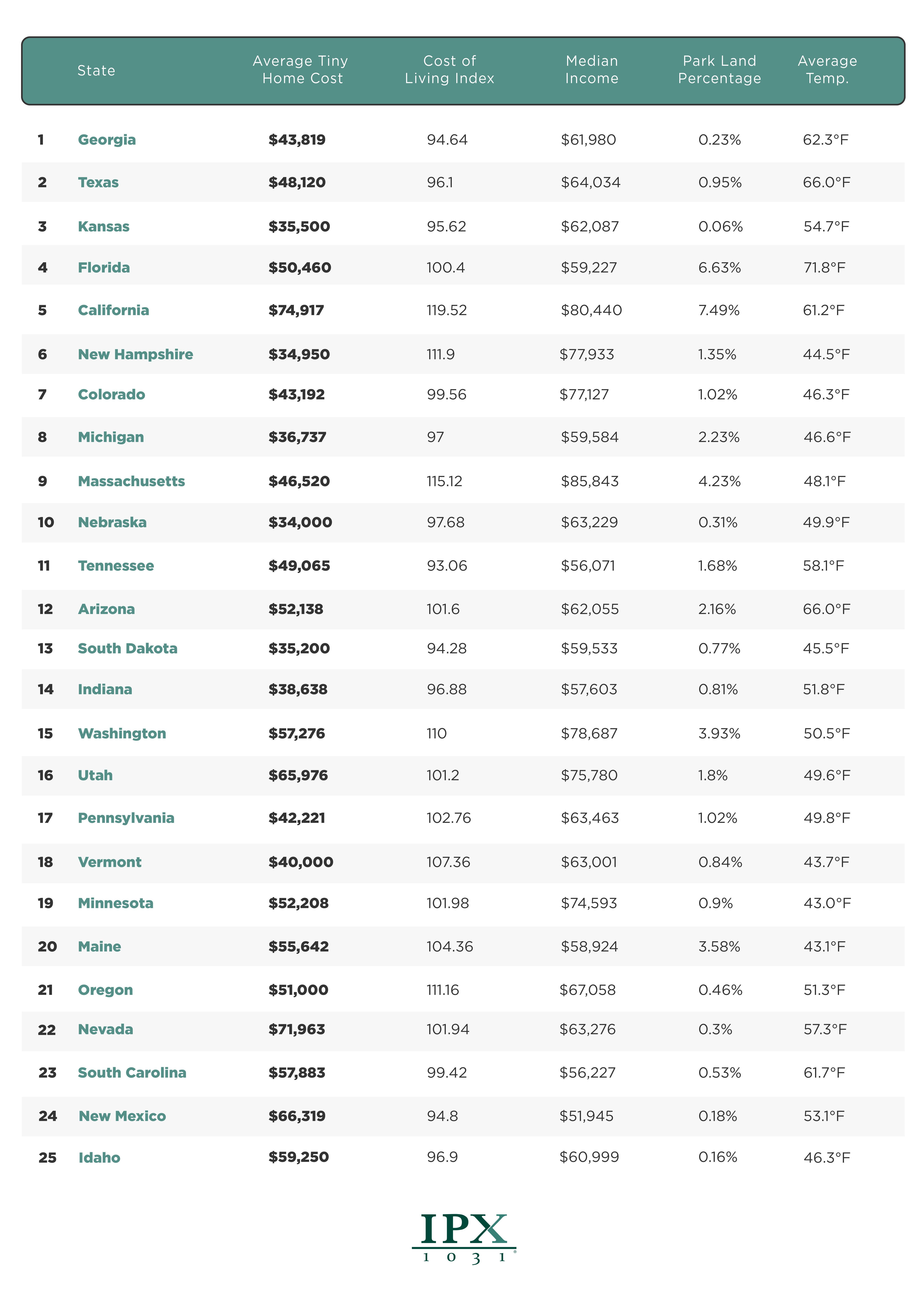

What are the Best States for Tiny Homes?

Along with the cost of buying a tiny home, there are many other factors to consider. First, potential buyers should be aware that many states, counties and cities have different rules, regulations and zoning requirements, which may prohibit them from building or buying a tiny home. In order to provide an accurate list of the best states for tiny homes, we excluded states that have strict laws against building a tiny home or living in a tiny home year-round.

Our ranking includes several other factors such as average cost to buy a tiny home, median income, cost of living index (food, health, transportation and miscellaneous costs), average annual temperature and percentage of state and local park space in each state for those who might be traveling with tiny homes on wheels.

#1 – Georgia

Northern Georgia’s Blue Ridge mountains offer some of the most picturesque landscapes for tiny home living, so it might not come as a surprise that the state is No. 1 on the list for best places for tiny homes. The average price of a tiny home is about $43,819 and the state has a mild climate with an average annual temperature of 62.3 degrees, which is ideal for the outdoor lifestyle that tiny home living provides.

#2 – Texas

Coming in at No. 2 is the Lonestar State. Sure, everything might be bigger in Texas, but that doesn’t mean your home has to be. With an average tiny home cost of $48,120 and a median income of $64,034, you can get the most bang for your buck when it comes to tiny living in Texas.

#3 – Kansas

While the average annual temperature might be a bit cooler than the first two states on our list, Kansas offers very affordable tiny home prices ($35,500) as well as a low cost of living and a median income of $62,087.

#4 – Florida

If it’s sunshine and outdoor living you’re looking for then look no further than Florida for tiny home living. The state’s abundance of both state and national parks make it ideal for indoor/outdoor living. The average cost of a tiny home runs around $50,460.

#5 – California

If you’re still craving sunshine, but prefer the west coast, California might be your best bet for tiny home living. Nearly eight percent of the state is covered by state and national parks, and the average annual temperature is a pleasant 61.2 degrees.

If you have an investment property or are planning on buying, click here to learn more about how a 1031 Exchange can help preserve your assets when selling and buying investment properties. Then read our How to Maximize 1031 Vacation and Rental Property During Pandemic Times for some timely suggestions. Click here for more information about IPX1031, the nation’s largest 1031 Exchange intermediary.

Methodology

In order to determine the best states for tiny homes, we looked at six key factors: tiny home cost, cost of living, median income, park land coverage, annual average temperature as well as tiny home legality and regulations in every state. Each factor was weighted and ranked on a 25-point scale.

Tiny home cost was determined by analyzing tiny home listings via Tiny House Listings and Tiny Home Builders.

Cost of living index was determined by analyzing food, transportation and health care via the Council for Community and Economic Research’s Cost of Living Index calculator.

Park land coverage was determined by analyzing the percentage of state and national park coverage in every state.

Annual average temperature was determined by analyzing the average temperature in every state via the National Oceanic and Atmospheric Administration.

Sources: National Oceanic and Atmospheric Administration, Zillow, Tiny House Listings, Tiny Home Builders, Council for Community and Economic Research, Tiny House Society, Green Matters, U.S. National Park Service

For media inquiries, contact media@digitalthirdcoast.net

Read more:

How to Buy Your Vacation Home with a 1031 Exchange

Strategically Buying Your Dream Vacation Home with a 1031 Exchange

Where the Vacation Home Market Has Grown the Most

Data Reveals Vacation Home Hot Spots Across the Country

Do Vacation and Second Homes Qualify?

Revenue Procedure 2008-16

Cities with the Most Airbnb Properties

Best Cities to Buy Airbnb Investment Property