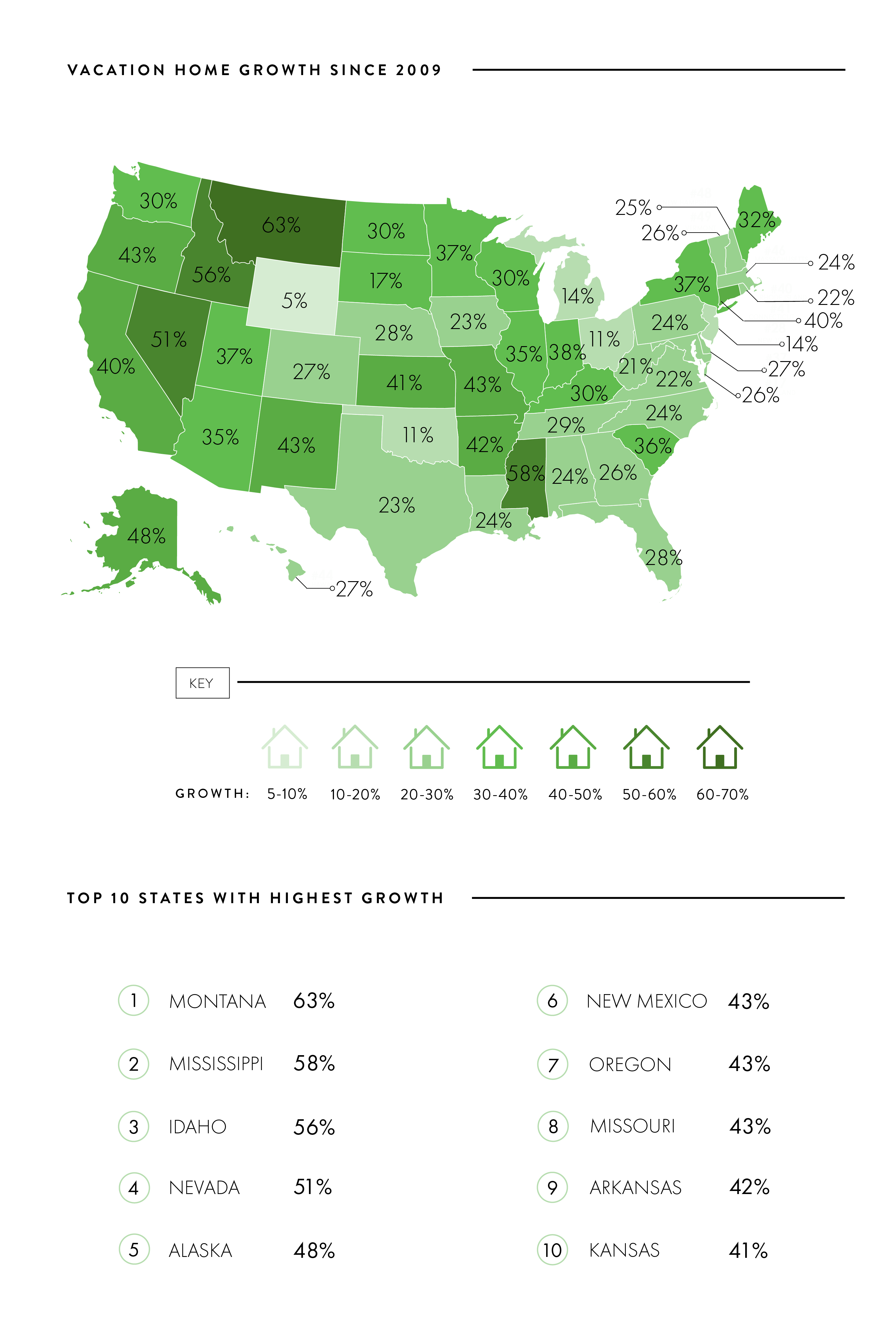

Where has the vacation home market grown the most? We were curious to find out, so we analyzed the total number of vacation homes in every state and calculated the overall growth since 2009.

Surprisingly, it’s not Florida or California, but Montana that tops the list at No. 1 with 63% growth followed by Mississippi (58%), Idaho (56%), Nevada (51%) and Alaska (48%). Perhaps vacationers are attracted to Montana’s picturesque Glacier National Park, Mississippi’s Gulf Coast, Idaho’s Shoshone Falls Park or Alaska’s Denali National Park.

New Mexico (43%), Oregon (43%), Missouri (43%), Arkansas (42%) and Kansas (41%) round out the top ten states with the most vacation home growth.

Nationwide, the number of vacation homes has increased by 29% since 2009. It’ll be interesting to see if that growth continues in the coming years and how this ranking holds up. Will states at the bottom of the heap like Wyoming (5%), Ohio (11%) and Oklahoma (11%) climb toward the top? One thing is for certain though – vacationing will never go out of style!

Click here to learn more about how a 1031 Exchange can help preserve your assets when selling and buying investment properties.

Methodology

We researched vacation home data across all 50 states and calculated each state’s overall growth from 2009 to 2017, which is the most recent data available from the Census Bureau. The Census Bureau defines vacation homes as housing units that are “vacant for seasonal, recreational, or occasional use.” Once we gathered the total number of vacation home units in each state we compared 2009 vs. 2017 to get an overall growth percentage.

For media inquiries, please contact media@digitalthirdcoast.net