We all know filing taxes can feel overwhelming, and it’s easy to push it to the back of our minds and leave it until the eleventh hour.

Many Americans still haven’t got a start on filing their taxes this year, despite having a later deadline with Tax Day on April 18th.

We wanted to know which states have the biggest procrastinators in the U.S. in 2022. To find this, we analyzed data from last year’s tax season to measure Google searches for phrases like “what happens if I file my taxes late?”, “when is it too late to file taxes?”, and “can I file late taxes?”

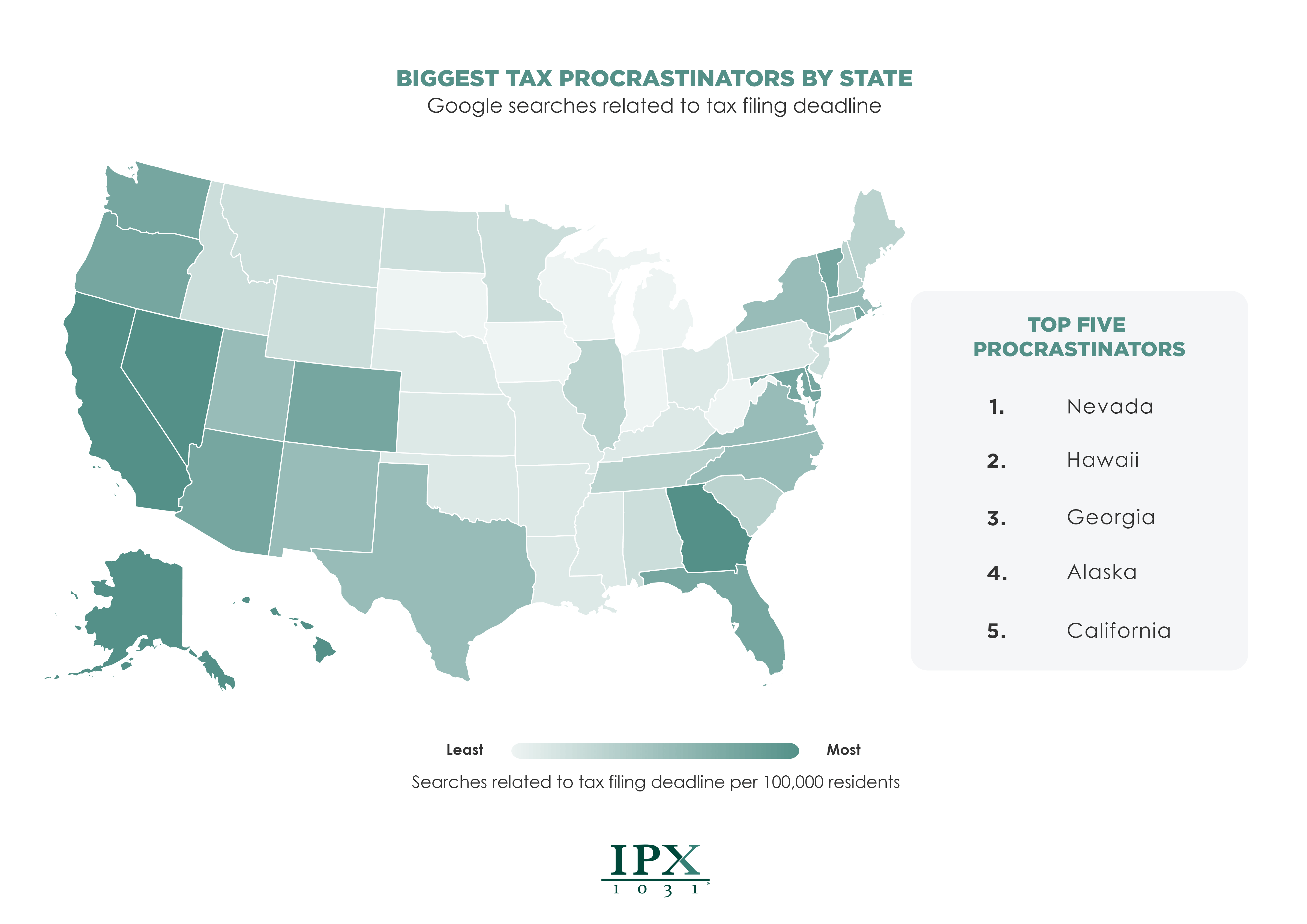

Biggest Procrastinators by State in 2022

Nevada remains in the top five biggest procrastinators by state, ranking No. 1 on the list when it comes to top procrastinators. Last year, Nevada ranked No. 4 in our 2021 Tax Day Procrastinators report.

Many of the top five procrastinating states from last year remain high in the list this year too, with Hawaii still in second place. Alaska dropped from No. 1 in 2021 to No. 4 in 2022, and California stayed in fifth position.

A few states that were ranked the lowest procrastinators in 2021 managed to keep their spot this year, like Iowa (No. 50), Wisconsin (No. 49) and Michigan (No. 48).

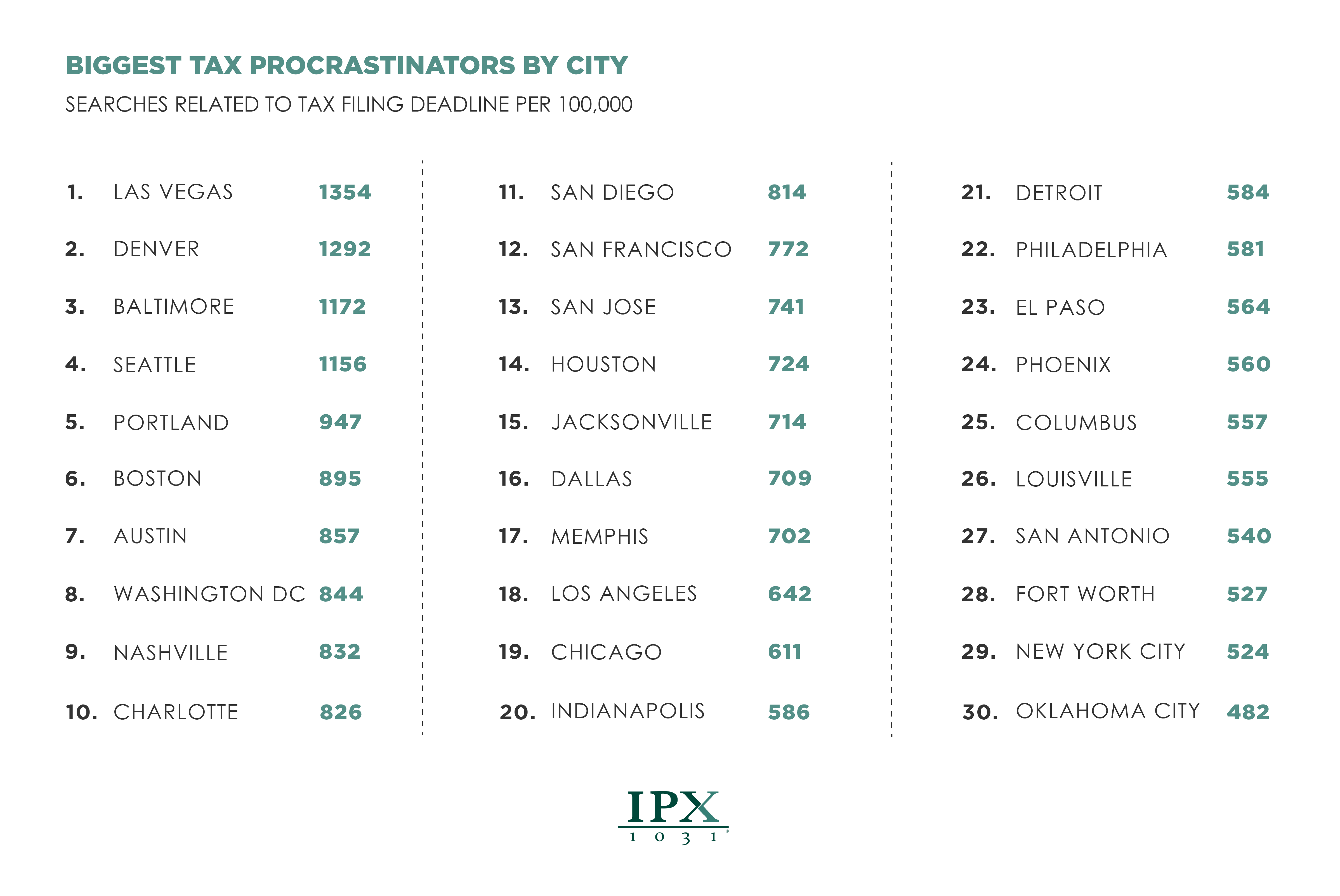

Biggest Tax Procrastination by City

Our analysis also looked at the top 30 biggest cities in the U.S. to see which had the most tax filing procrastinators in 2022.

For the third year in a row, Las Vegas remains No. 1 for the biggest tax procrastinators by city. Denver also held its spot from last year, once again ranking at No. 2.

Baltimore (No. 3), Seattle (No. 04), and Portland (No. 5) all made the top five once again this year, but in a slightly different order than last year.

New York City also remains in the same spot as last year, and props to Oklahoma City for jumping from No. 19 to No. 30 and improving their procrastinating habits this tax season.

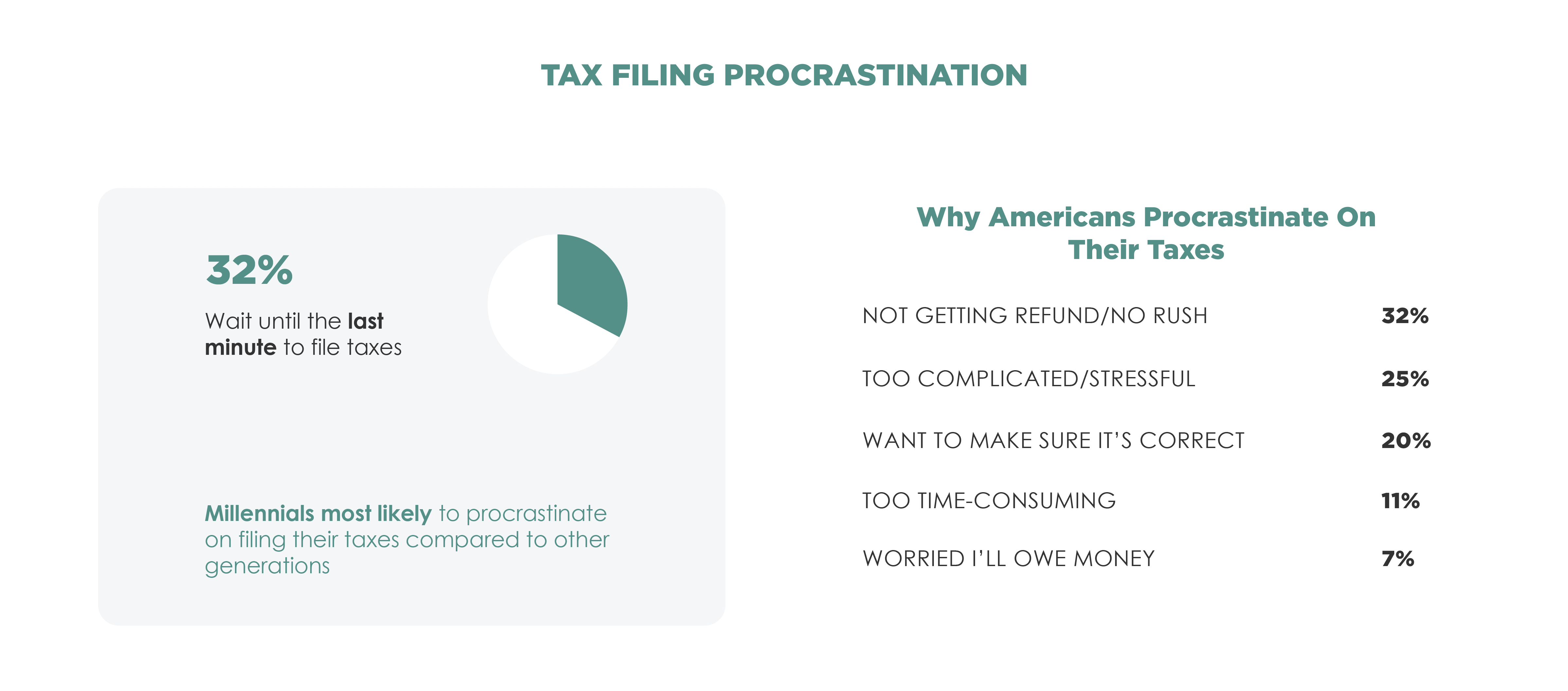

2022 Tax Filing Procrastination

If you usually find yourself leaving your filing until the last minute, you’re not alone. Our survey found that almost one third of all Americans (32%) wait until the last minute to file their taxes.

Most respondents said the reason they wait until the last minute is because they don’t think there’s a rush and they assume they aren’t getting a refund. The next top reason is that they find filing taxes “too stressful and complicated”.

2022 Tax Refund Expectations

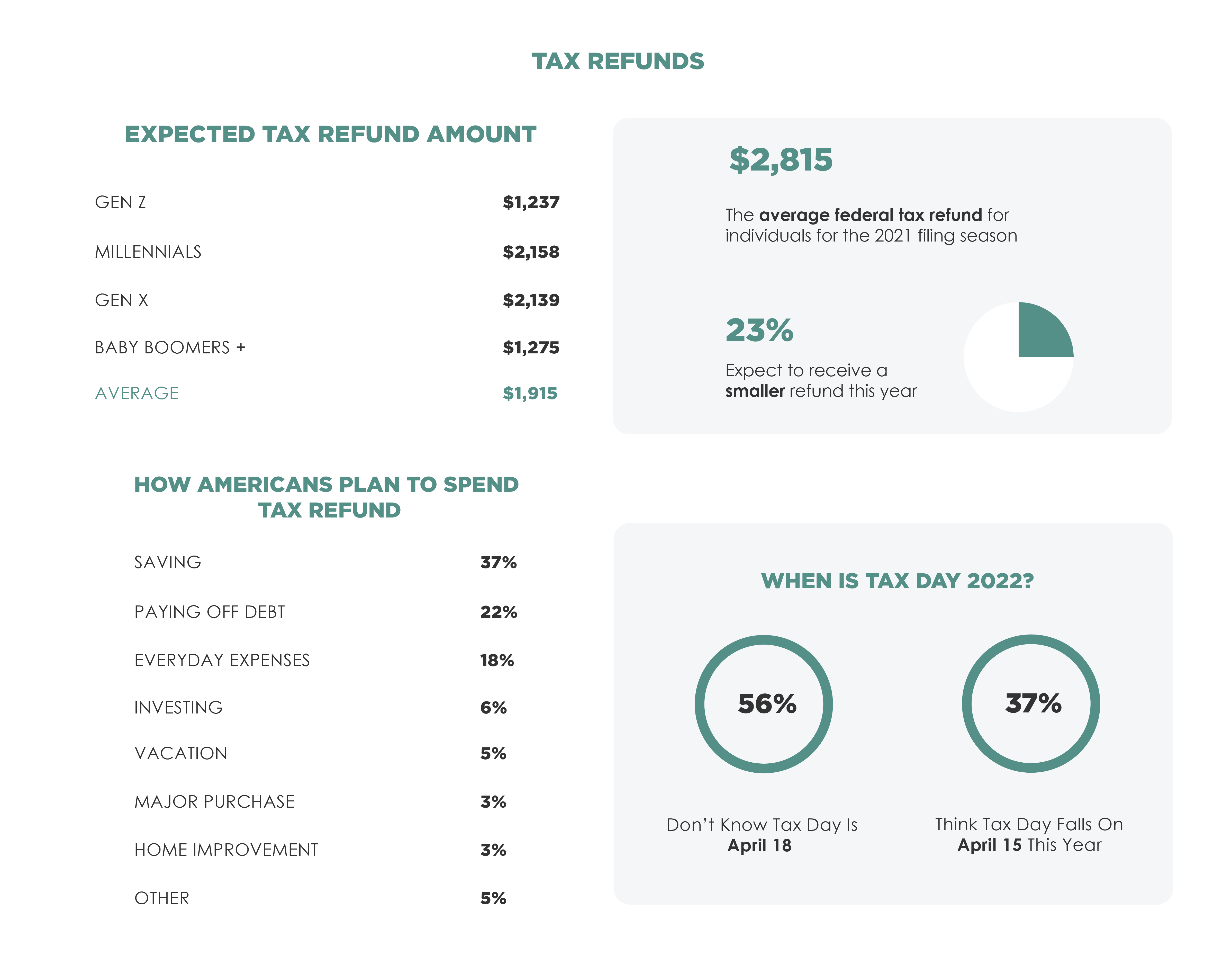

According to the Internal Revenue Service (IRS), the average federal tax refund in 2021 was $2,815. That’s $108 more than the previous year. Interestingly, Americans only expect a return of an average of $1,915, which is 32% lower than the actual average tax refund.

Despite many Americans saying they put filing taxes off until the last minute due to stress or not expecting a refund, many do make plans of what to do with the extra cash. Most (37%) say they plan to save their refund, and 22% say they plan to use it to pay down debt.

When is Tax Day 2022?

This year Tax Day is on April 18th, but 37% of Americans think it is on the usual date–April 15th. Just over half of Americans (56%) don’t know that it falls on a different date this year.

Luckily, 50% of our survey respondents say they’ve already filed their taxes. Of those, 11% have already spent their tax refund money.

Even though you have three extra days to file your taxes this year (because Washington, D.C. observes the Emancipation Day holiday on April 15th), remember that filing on time is important.

Taxpayers in Maine and Massachusetts have until April 19th to file this year due to the Patriots’ Day holiday. If you haven’t already, set a reminder now to make sure you get in well before your state’s deadline.

If you are interested in deferring your taxes on investment real estate, consider a 1031 Tax Deferred Exchange. You can use our Capital Gain Estimator or click here to learn more about how a 1031 Exchange can help preserve and grow your assets when selling and buying investment properties.

Methodology

In March 2022, we surveyed 1,112 Americans between the ages of 18-80. The average age of respondents was 40 years old. Using the Google AdWords platform, we analyzed total search volume for tax filing keywords (and similar variations.) Search volume for these phrases and keywords was analyzed for last year’s tax season from January 2021 until May 2021. Total search volume during this period was then calculated per capita and visualized per 100,000 people for each state and major metro city with a population of 600,000 or more.

For media inquiries, contact media@digitalthirdcoast.net

Read more:

1031 Information Exchangers Should Know When Filing Taxes

Tax Day 2024: America’s Biggest Procrastinators

Tax Day 2023: America’s Biggest Procrastinators

Tax Day 2021: America’s Biggest Procrastinators

Tax Day 2020: America’s Biggest Procrastinators

1031 Exchange and Defer? Or Sell and Pay Taxes?

Best Large Cities to Buy Investment Property 2020