Rev Proc 2005-14: Combining Primary Residence Exemption with a 1031 Exchange

An effective way to minimize one’s tax liability is by combining the benefits of multiple tax code sections. In the 1031 Exchange industry, a way we see this strategy utilized is with the guidance provided in Revenue Procedure 2005-14. The Revenue Procedure allows taxpayers to take advantage of the Primary Residence Exclusion under §121 AND the tax deferral benefits of §1031.

Code Section 121

Under §121(a) if a taxpayer uses the property as their Primary Residence for two (2) out of the last five (5) years, the taxpayer can exclude some or all of the gain (from their income) on the sale of the primary residence if certain conditions are met:

- The amount of gain excluded shall not exceed $250,000 (a single-filer) or $500,000, if married filing jointly;

- The §121 Exclusion may only be used once every two (2) years;

- Gain excluded only applies to gain accrued during a “qualified use” period. Simply put, gain accrued while the property was not used as a Primary Residence is not eligible to be excluded;

- The §121 Exclusion may not be applied to any depreciation taken since 1997.

Code Section 1031

A taxpayer can utilize a 1031 Exchange to defer paying Federal capital gains tax, state income tax, the Net Investment Income Tax, and depreciation recapture when selling a qualifying business or investment property(s), as long as certain conditions are met.

Common Usages of Revenue Procedure 2005-14

Two common usages of Revenue Procedure 2005-14 are when a taxpayer converts their Primary Residence into an “Investment Property”, or when a taxpayer treats a portion of a property as their Primary Residence and the remainder as an “Investment”.

Converting a Primary Residence into an Investment Property

Let’s assume Husband (“H”) and Wife (“W”) purchased their primary residence in 1985 for $100,000 and they lived in the property as their Primary Residence until 2016. At that time they moved out and started renting the property. By renting the property out for two (2) consecutive years, they successfully converted the property to a qualifying “Investment Property” for the purpose of a 1031 Exchange. Revenue Procedure 2008-16.

H and W are now ready to sell the property for $1,000,000, with an adjusted basis of $100,000. They can utilize both §121 and §1031 as follows:

- Sell the property for a net sales price of $1,000,000;

- Take their full $500,000 exemption under §121. This allows H and W to exclude $500,000 from their income;

- However, because of the large amount of appreciation on the property, they are still subject to taxes on approximately $400,000 [$1,000,000 (net sales price) -$500,000 (§121 Exclusion) – $100,000 (Adjusted Basis)]

- At this point, they can then utilize a 1031 Exchange on the remainder of the net proceeds from the sale of the rental property. The investment requirements remain the same (as a normal 1031 exchange) to obtain a full deferral of taxes:

- H and W will need to buy a replacement for at least $500,000;

- The amount of equity in the Replacement Property will need to be equal to or greater than the equity in the Relinquished Property;

- The amount of debt in the Replacement Property will need to be equal to or greater than any debt paid off on the sale of the Relinquished Property.

By completing a successful 1031 Exchange, H and W will be able to defer a potential six-figure tax bill, while also acquiring a replacement property that will provide them with a source of passive income.

Owner Selling Multi-Family or Mixed-Use Property

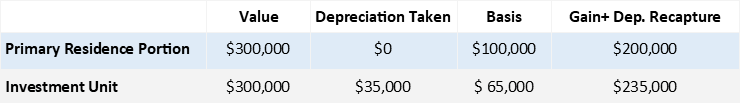

A single-filer taxpayer owns a duplex, in which he lives in one of the units. The taxpayer purchased the property in 2009 for $200,000, allocating $100,000 of basis to each unit. After 10 years, taxpayer decides to sell the duplex, when it has a fair market value of $600,000. This will look as follows:

- When the taxpayer goes to sell the property, he will first apply the §121 Exclusion to the $200,000 of gain on the portion used as its Primary Residence.

- To defer the tax liability on the Investment Unit, taxpayer can now take advantage of code section §1031.

- To fully defer taxes, the taxpayer would need to purchase a replacement property for at least $300,000. If he complies with the requirements of a 1031 exchange, he will be able to exclude the gain attributable to his primary residence and defer all taxes related to the investment portion of the duplex.

Revenue Procedure 2005-14 can be a very valuable tool. For further guidance on how to fully maximize this powerful strategy, please contact IPX1031.

READ MORE

Converting Your Primary Residence Into Rental Property

Opportunities of the 1031 Exchange

Capital Gain Estimator

1031 Knowledge Center