The Tax Deferred Exchange, as defined in §1031 of the Internal Revenue Code, offers taxpayers one of the last great opportunities to build wealth and save taxes. By completing an exchange, the Taxpayer (Exchanger) can dispose of investment or business-use assets, acquire Replacement Property and defer the tax that would ordinarily be due upon the sale.

To fully defer the taxes on capital gain or depreciation recapture, the Exchanger

must:

(a) “like kind” Replacement Property that will be held for investment or used productively in a trade or business,

(b) purchase Replacement Property of equal or greater value,

(c) reinvest all of the equity into the Replacement Property, and

(d) replace the value of the debt on the Replacement Property. Debt may

be replaced with additional cash, but cash equity cannot be replaced with additional debt. Additionally, the Exchanger may not receive cash or other benefits from the sale proceeds during the exchange.

Effective January 1, 2018, IRC §1031 applies only to real property assets. It does not apply to exchanges of personal property, stock in trade, inventory, or property held for sale, such as property acquired and developed or rehabbed for purposes of resale.

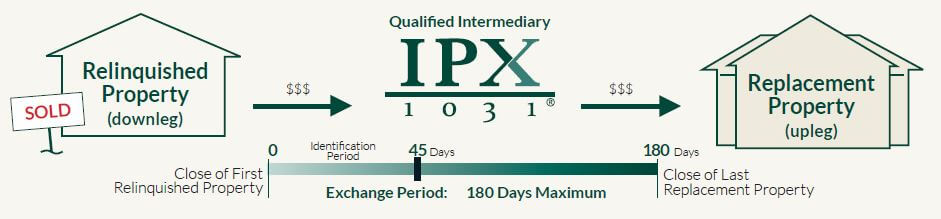

An exchange is rarely a swap of properties between two parties. Most exchanges involve multiple parties: the Exchanger, the buyer of the Exchanger’s old (Relinquished) property, the seller of the Exchanger’s new (Replacement) property, and a Qualified Intermediary. To create the exchange of assets and obtain the benefit of the “Safe Harbor” protections set out in Treasury Regulation 1.1031(k)-1(g)(4) which prohibits actual or constructive receipt of Exchange Funds, prudent taxpayers use a professional Qualified Intermediary, such as Investment Property Exchange Services, Inc. (IPX1031).