We are in the height of March Madness. And the adrenaline pumped ride from Sunday Selection all the way to the championships takes hours and hours of training, strategic finesse and flawless teamwork and execution.

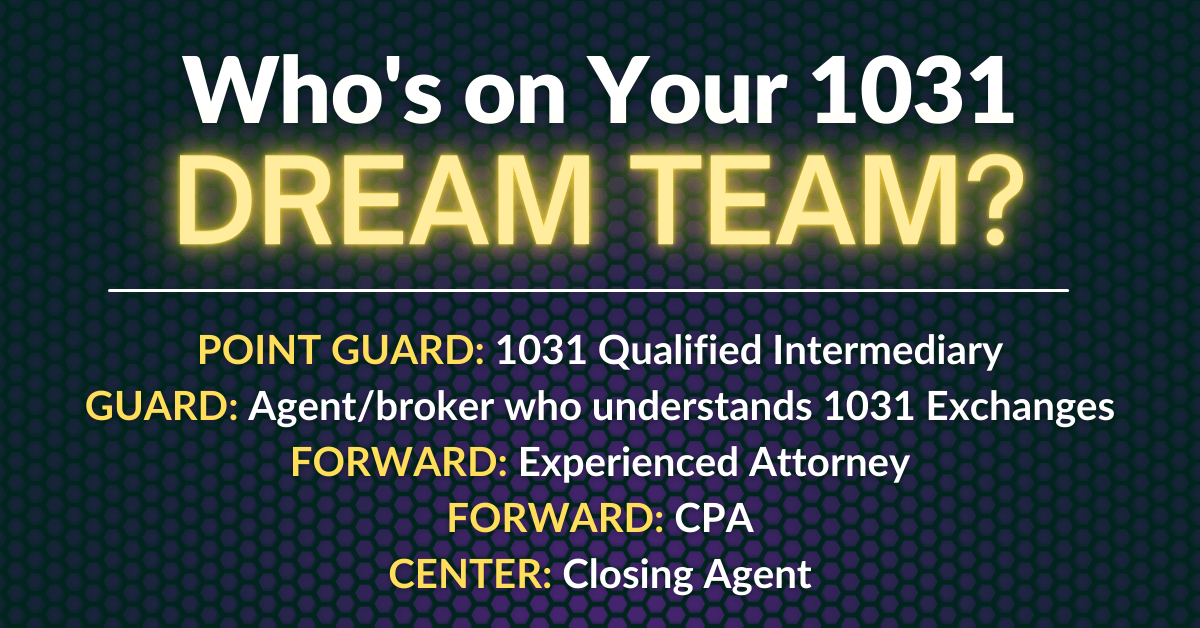

In the 1031 game, if you or your clients are considering a tax deferred exchange, what kind of “Dream Team” should you build for your full court press? Here’s your 1031 starting lineup:

- 1031 Qualified Intermediary. This is your point guard. Your most crucial and key position. Choose a reputable, well-known Qualified Intermediary (QI) to strategically position and drive your 1031 game forward. Your QI is strategic, knows the 1031 game inside and out, including what’s happening around you with the other players – i.e., recent rulings that may affect your situation and will be available to your tax advisors to work with concerning your 1031 Exchange. Your QI prepares and manages the pertinent documents to comply with safe harbor regulations and coordinates with your team.

- An agent/broker who understands 1031 Exchanges. This is your guard. You want to have the best and the most experienced residential or commercial real estate agent/broker involved. Your agent/broker needs to be familiar and comfortable with 1031 Exchanges. Your agent/broker must be on top of their game such as putting a cooperation clause in the listing agreement and in the purchase agreement that gives notice to all parties that the taxpayer is doing an exchange. Inexperience here may lead to a quick single game elimination.

- An experienced attorney. A lawyer is your forward that will give you points and legal advice on any gray areas in your transaction. While your Qualified Intermediary can tell you about the 1031 tax code, QIs cannot offer specific legal advice. Your attorney is a critical player especially with complex transactions. You want your forward scoring for you here and big. Double digit big.

- A CPA. Here’s your other forward. It is important that you choose a CPA who understands tax deferred exchanges and one to determine how a 1031 is your best strategic play. You will want to involve your CPA early in the planning stages of your sale, and then keep passing the CPA your information as you progress through your game. That way, when it comes time to report the exchange on your tax return, your CPA is familiar with the transaction. No fouls wanted here. Only net.

- A closing agent. A competent, certified closing agent is your scoring center. Depending on where you are selling, that might be an attorney or an escrow/title officer. Disbursement of funds and proper closing statement documentation are just a few of the main concerns with a 1031 Exchange. You do not want any accidental disbursements of monies or problems with closing within your deadline. Choose someone who can slam dunk.

IPX1031 – Rounding Out Your Team

As a nationwide leader in tax deferred exchanges, IPX1031 is here to offer you the best in service, experience and security. When you choose IPX1031 as your Qualified Intermediary, you can be confident that your funds will be safe, secure, and available when needed. IPX1031 strives to help our clients and their advisors keep current on tax and industry issues pertaining to 1031 Exchanges. For more information about us, additional resources, or our complimentary monthly webinars, visit our website at www.ipx1031.com.