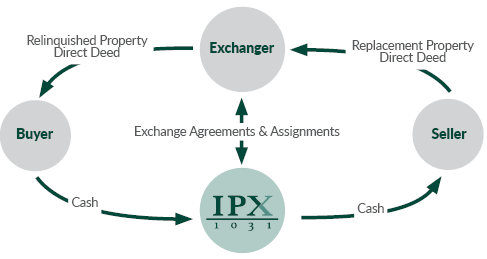

In a Simultaneous Exchange, the old Relinquished Property and the new Replacement Property are transferred concurrently between the two trading parties or with the use of a Qualified Intermediary. In a Delayed Exchange, the Exchanger transfers Relinquished Property to a buyer, and acquires Replacement Property from a third-party seller at a subsequent time. Investors performing exchanges without the benefit of a Qualified Intermediary may risk losing the tax deferred status of the transaction, especially if there is any delay in receipt of Replacement Property or multiple parties are involved.

In a Simultaneous Exchange, the old Relinquished Property and the new Replacement Property are transferred concurrently between the two trading parties or with the use of a Qualified Intermediary. In a Delayed Exchange, the Exchanger transfers Relinquished Property to a buyer, and acquires Replacement Property from a third-party seller at a subsequent time. Investors performing exchanges without the benefit of a Qualified Intermediary may risk losing the tax deferred status of the transaction, especially if there is any delay in receipt of Replacement Property or multiple parties are involved.

The Tax Court in Keith K. Klein v. Commissioner, 66 T.C.M. 1115 (1993), determined that one simultaneous three-party exchange was a fully taxable sale. Mr. Klein’s closing escrow instructions simply assigned his rights to the proceeds from the sale of his Relinquished Property directly to the second closing for the purchase of

his Replacement Property. The Tax Court stated that Mr. Klein had unrestricted control over, and thus had constructive receipt of, the Exchange Funds in his transaction. Klein argued that the provision in his earnest money agreement stated that the buyer would cooperate in structuring a Tax Deferred Exchange. He believed

that the funds in escrow were already assigned to the seller of the Replacement Property and therefore, he had no control over the funds. The Court indicated that the cooperation clause would not control the constructive receipt issue. Unwary taxpayers who do not utilize a Qualified Intermediary may be surprised to discover their transaction does not qualify for tax deferral.

Use of a Qualified Intermediary acting under an Exchange Agreement insulates the Exchanger from constructive receipt issues on the proceeds. Although the Qualified Intermediary does not hold any proceeds in a Simultaneous Exchange, it serves the important function of creating a reciprocal trade since the Qualified Intermediary is deemed to have received and transferred the Relinquished Property and subsequently acquired and transferred the Replacement Property to the Exchanger to complete the exchange. The Qualified Intermediary also controls the flow of the Exchange Funds.