A “reverse” exchange occurs when the taxpayer acquires the Replacement Property before transferring the Relinquished Property. A “pure” reverse exchange, where the taxpayer owns both the Relinquished and Replacement Properties at the same time, is not permitted. As a workaround, enterprising taxpayers structured “parking” transactions. An accommodation party (AP) would acquire and hold the Replacement Property until the taxpayer could transfer the Relinquished Property in a customary forward exchange. A major challenge of the parking arrangement was to give the AP enough benefits and burdens of the Parked Property to be treated as the owner for federal income tax purposes.

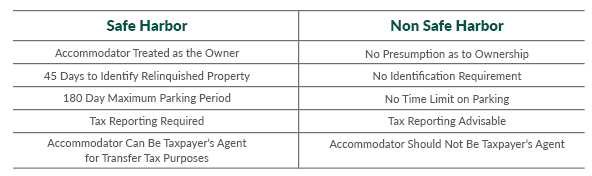

Revenue Procedure 2000-37 was issued by the IRS to provide taxpayers with a “safe harbor” to qualify their parking transactions under §1031. If the conditions of the safe harbor are met, the IRS will treat the AP as the beneficial owner of the Parked Property. Also, the IRS will not question whether the Parked Property qualifies as “Replacement” or “Relinquished” for purposes of §1031.

One condition of the safe harbor is that the AP can only hold the Parked Property for 180 days. That time requirement is an impediment to transactions where the Replacement Property needs improvements that will take more than 180 days to complete, or where the Relinquished Property takes longer to sell. As a result, some taxpayers choose to stay outside the safe harbor, in a “non-safe harbor exchange”. Outside the safe harbor the IRS has historically applied a benefits and burdens test to determine whether the true owner of the Parked Property is the AP or the taxpayer.

Whether inside or outside the safe harbor, the structure and documentation of the reverse exchange is very similar. The difference lies in the protections provided by the safe harbor.

The landscape changed for non-safe harbor transactions with the 9th Circuit Tax Court’s decision in Estate of George H. Bartell, Jr. v. Commissioner, 147 T.C. No. 5 (2016). In that case the AP held the property for 17 months. The AP had no appreciable benefits or burdens of ownership. The IRS argued that under a benefits and burdens test the taxpayer was the true owner, not the AP. The Court disagreed, holding that the AP may hold title solely for the purpose of an exchange. The AP was not required to have any benefits or burdens of ownership of the Parked Property to have a valid exchange. Also, the AP could be contractually insulated from risk by the taxpayer. An important factor in the Court’s decision was that the AP was not the agent of the taxpayer.

Bartell makes it easier for a taxpayer to structure a non-safe harbor exchange, since the AP no longer needs to have benefits and burdens of ownership. There is some tax risk, as the IRS may not follow Bartell outside the 9th Circuit. Some state courts may also be reluctant to adopt the Bartell opinion. Taxpayers should consult their tax professionals when contemplating a non-safe harbor exchange. For a better understanding of how this case may benefit you, please contact your IPX1031 representative. We will be happy to work with you and your tax professionals to craft a solution that will best fit your needs.