Updated findings of Ernst & Young’s (EY) May 2021 research about the Economic Contribution of Sec. 1031 Like-Kind Exchange to the US Economy in 2021 were released May 2022. The study measures not only the direct impact on taxpayers engaged in like-kind exchanges, but also the ancillary stream of indirect economic activity spawned by exchanges that involves suppliers to exchanging taxpayers and related consumer spending from income generated by employees and other businesses within the supply chain. By looking at all three levels of economic activity, EY was able to quantify what a powerful driver Section 1031 is to the US economy.

In last year’s May 2021 report, EY used economic factors from 2019 (pre-pandemic) to estimate the economic impact of like-kind exchanges for 2021, based upon the assumption that 2019 economic activity would be a realistic proxy for 2021. Clearly, the US economy sprang back much faster than anticipated, and 2021 real estate activity far surpassed that of 2019. EY revised some of its findings in the May 2022 updated report using economic trends based upon actual activity from full year 2021 economic data. EY found that the impact of Section 1031 was significantly greater than the original estimate. Among other factors, this growth may be attributed, in part, to a rebound in the economy and to the need to transition or repurpose existing properties to meet post-pandemic business models and changing tenant needs. These trends seem to be in the beginning phases, and may well continue, to some degree, into future years. To that extent, the adjusted findings may be reflective of future annual economic activity supported by Section 1031 like-kind exchanges.

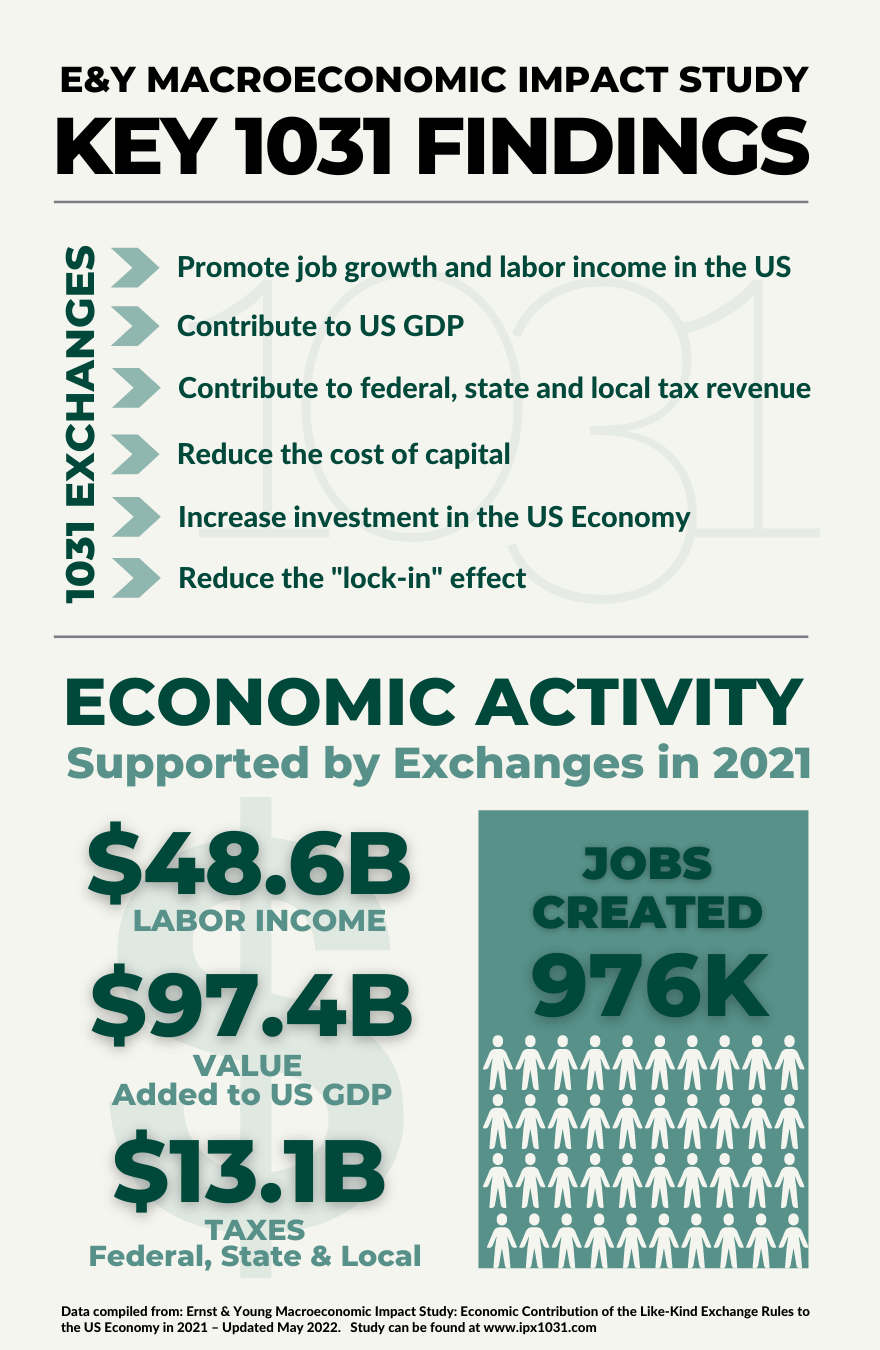

Ernst & Young Macroeconomic Impact Study: Economic Contribution of the Like-Kind Exchange Rules to the US Economy in 2021 – Updated May 2022

read summary here

read full study here

EY Infographic on Economic Contribution of LKE

READ MORE

IPX1031 Tax Reform resources