The Opportunity Zones that were created by the Tax Cuts and Jobs Act have generated a fair amount of buzz in the legal, accounting and real estate communities and have raised questions on application to 1031.

An Opportunity Zone (OZ) is an economically distressed census tract. OZs are designed to provide tax incentives to investors with the stated purpose of getting the private sector involved to spur economic development and job creation in distressed communities. These areas are in need of assistance. Over half the communities eligible for designation as Opportunity Zones had fewer jobs and fewer businesses in 2015 than in 2000.

Unfortunately an investment in an OZ fund cannot be structured as a 1031 Exchange. An investor can neither identify an OZ fund as a Replacement Property in a 1031 Exchange, nor utilize a 1031 Exchange when an OZ fund is sold. Since OZ funds are not real estate – they are Qualified Funds structured as corporations or partnerships – they are not eligible to be Replacement or Relinquished Property in a 1031 Exchange.

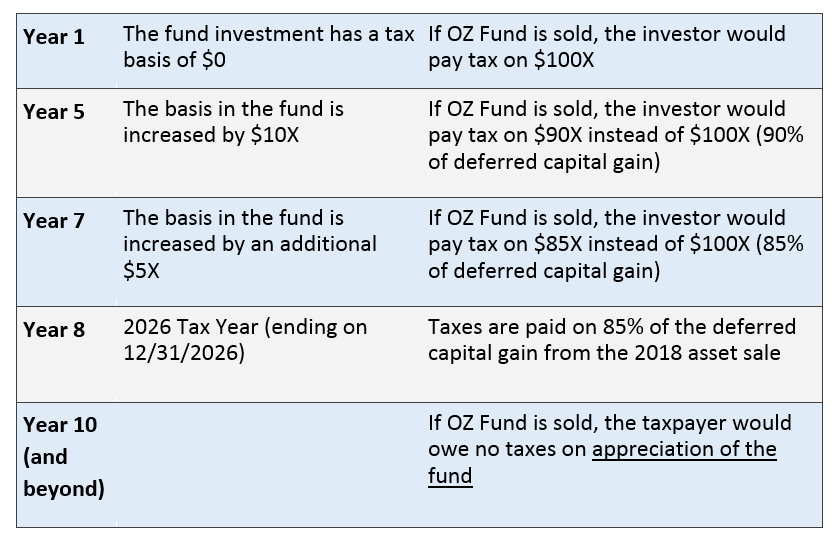

Another issue to keep in mind is that not all capital gain will be tax free in an OZ fund investment. The tax free treatment for owning an OZ investment only applies to the gain in the Opportunity Zone investment, not the gain from the initial capital asset sale used to invest in the OZ fund. An example of what happens to an OZ fund investment that is made in 2018 is illustrated below:

Assume a capital asset sold in 2018 for $150X with a capital gain of $100X. Within 180 days the $100X is invested in an OZ fund.

As with any investment, there are risks. Accordingly, it is essential that a potential investor seek the assistance of competent legal, tax and financial advisors to help them evaluate whether an OZ fund is a good investment for them.

Due diligence questions that might be asked of a sponsor of an OZ fund might include: Are they experienced in real estate investments and developments? Have they operated during an economic downturn? How financially secure are they? What protections are made for the investment?

With regard to the OZ fund, questions might include: What properties are in the fund? Are they currently performing and is that expected to continue long term? How is the fund expected to perform in an economic downturn and why? This last question is particularly relevant because OZs are located in economically distressed areas which are frequently hit the hardest in an economic downturn.

After due diligence, many sellers of real estate may decide that OZ funds are not appropriate since they only permit tax deferral until 12/31/2026 (at the latest) and represent a “dead end” for the deferral of taxes. It is essential to have these potential investments reviewed from a legal, tax and financial perspective to determine what strategic investment is best for your circumstances.

Read more: Opportunity Zones Frequently Asked Questions – IRS