IPX1031 is your in-house FNF solution for 1031 Exchanges.

Pitfalls When Offering 1031 Services PDF

Largest and most secure QI in industry

Expeditious document preparation for last minute exchanges

Access to IPX team of legal, tax and 1031 experts

IPX1031 works with your client’s tax advisors for a smooth process

Complimentary 1031 presentations that can qualify for professional continuing education

Access to key industry information & updates

2023 Data Sheets

July 2023 – Top 1031 Misconceptions for 2023

June 2023 – Underperforming Real Estate Assets Ripe for 1031

May 2023 – Flexibility with Combination 1031 Exchanges

April 2023 – Agriculture 1031 Exchanges

March 2023 – Reverse Solutions in a Challenging Market

February 2023 – Who Has Control of Your 1031 Money? Security of 1031 Exchange Funds.

January 2023 – 1031 Exchange Trends & Info for 2023

2022 Data Sheets

December 2022 – Fourth Quarter 1031 Exchanges May Have Shorter Time Periods

November 2022 – 1031 Exchange Benefits To Be Thankful For

October 2022 – Tax Straddling – Pay Taxes in 2023 or 2024?

September 2022 – How to Buy Your “Dream Home” with a 1031 Exchange

August 2022 – Is a Partial Exchange a Valid 1031 Exchange?

July 2022 – Top Misconceptions About 1031 Exchanges for 2022

June 2022 – 1031 Exchange and Defer? Or Sell and Pay Taxes?

May 2022 – DST 1031 Exchanges

March 2022 – The Five Professionals to Have on Your 1031 Dream Team

February 2022 – How to Identify 1031 Exchange Property

January 2022 – 1031 Exchange Trends & Info for 2022

Why Agents & Customers Choose IPX1031

IPX1031 is a full service Qualified Intermediary and has offices and 1031 experts nationwide. With a team of savvy attorneys, CPAs and Certified Exchange Specialists, IPX1031 can meet with your client and team via phone, video calls, email and in person.

Safety & Security

Expertise, Solutions & Strategies

Reputation

Full Service QI

Competitive Pricing

Longevity

Financial Assurances

Strength of FNF parent company

National with Local Presence

Complimentary Consultations

Client Service

Industry leader

Why a 1031 is right for my client’s investment property

There are many advantages to structuring your investment transaction as a 1031 Exchange

(also known as Tax Deferred Exchange, Like Kind Exchange, Starker Exchange and Real Estate Exchange).

deferring taxes (up to 35 to 40% of the gain)

greater purchasing power

improved cash flow

portfolio diversification

portfolio consolidation

greater appreciation potential

freedom from joint ownership

estate planning for heirs

TOLL FREE NUMBER

888-771-1031

EMAIL

info@ipx1031.com

Our IPX1031 Locations

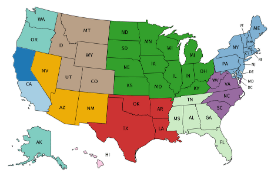

IPX1031, the nation’s largest 1031 Exchange Facilitator / Qualified Intermediary, has a true “National” presence, with over 35 locations to serve the entire country. To find our company 1031 Exchange Services OFFICE or a 1031 Exchange EXPERT nearest you, type in your zip code in the search box or click on one of the regions in the map below.

Mobile Map

Mobile Map

Customized solutions for your clients’ investment and business goals